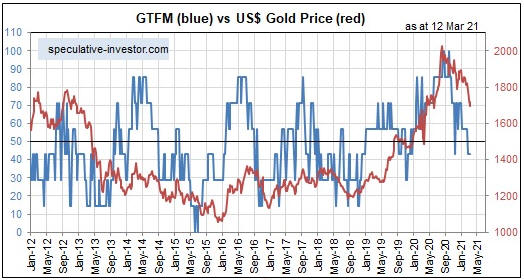

For the first time in a long time, the sentiment backdrop recently became supportive for the gold price. However, the true fundamentals have been trending in a gold-bearish direction since early-October of last year (after having been supportive for almost a year before that) and still constitute a headwind for the gold price.

When it comes to assessing gold market sentiment, the Commitments of Traders (COT) report provides by far the most useful data. This is because it shows what speculators, as a group, are doing with their money in the part of the market (Comex futures) that is subject to the greatest sentiment swings and that has the greatest effect on short-term price movements.

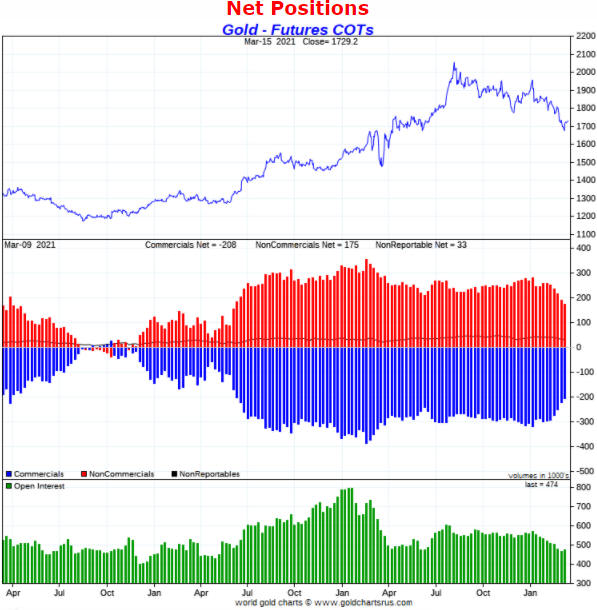

At the moment, the total speculative net-long position (the inverse of the blue bars shown in the middle section of the following chart) is at its lowest level since June-2019. This implies that speculators are now less interested in gold than at any time over the past 20 months. Of greater importance is that the open interest (the green bars shown in the bottom section of the chart) is not far from its lows of the past three years. This is important because the gold price tends to bottom when the futures market open interest is relatively low.

Chart source: http://www.goldchartsrus.com/

The COT situation tells us that speculator enthusiasm for gold is now at a low ebb relative to the past couple of years, which is bullish given that speculator sentiment is a contrary indicator. At the same time, though, the fundamental backdrop remains bearish.

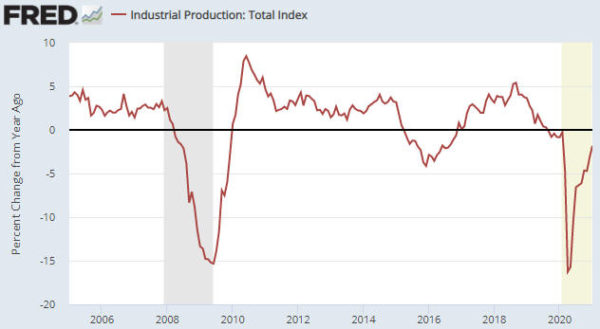

In broad-brush terms, the fundamental backdrop is bearish for gold when confidence in the economy and the financial system is high or increasing and bullish for gold when confidence in the economy and the financial system is low or decreasing. Confidence may seem like a vague concept, but it can be quantified using interest-rate spreads, price ratios and other market data.

The Gold True Fundamentals Model (GTFM), a weekly chart of which is displayed below, is my attempt to quantify the fundamentals that matter to the gold market.

When the fundamental backdrop is gold-bearish the best that can be reasonably expected from the gold price is a multi-week countertrend rebound, even when the sentiment situation is supportive. That appears to be what’s happening at the moment.

I expect that the fundamentals will turn in gold’s favour within the next three months as the US economy and many other economies around the world begin to shift from strong economic rebound to “stagflation”. However, they haven’t turned yet.

Print This Post

Print This Post