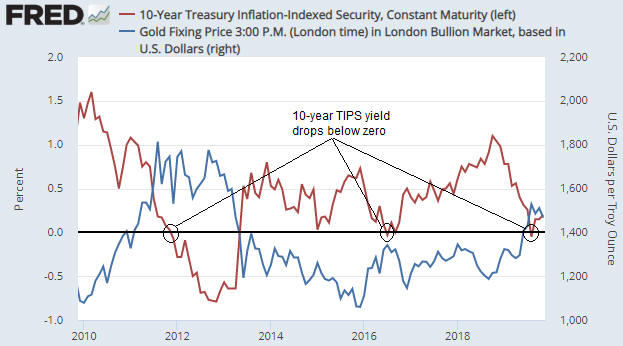

In a blog post in early-September I noted that the 10-year TIPS (Treasury Inflation Protected Security) yield had just gone negative and that the previous two times that this proxy for the real interest rate went negative (August-2011 and July-2016) the gold price was at an important peak. I then attempted to answer the question: If gold tends to benefit from a lower real interest rate, why would the gold price reverse downward shortly after the real interest rate turned negative?

In the earlier post I gave three reasons why a downward reversal in the gold price could coincide with the ‘real’ interest rate going negative. They were:

1) The dip into negative territory marked a low point for the real interest rate.

2) The real interest rate is just one of several fundamental gold-price drivers, so the upward pressure on the gold price exerted by a falling real interest rate could be counteracted by the downward pressure exerted by other fundamental influences.

3) The gold-bullish fundamental backdrop had been fully discounted by the current gold price.

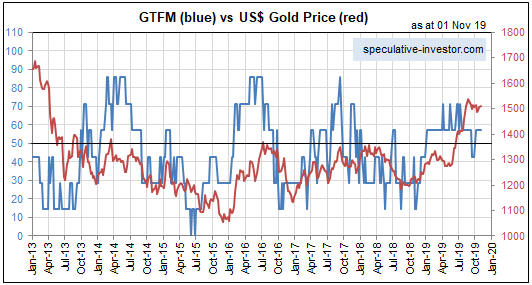

At the time I thought that the third of the above-mentioned reasons may be applicable, because the speculative net-long position in Comex gold futures was very close to an all-time high and the weekly RSI (an intermediate-term momentum indicator) was almost as high as it ever gets.

As it turned out, the first and third reasons were applicable. Sentiment and momentum indicators pointed to extreme enthusiasm for gold on the part of the speculating community, and the following chart, which is an update of the chart included in the blog post linked above, shows that the 10-year TIPS yield reversed upward at the beginning of September.

The current situation is that neither sentiment nor fundamentals are conducive to substantial strength in the gold price. There could be a counter-trend rebound at any time, but the conditions are not right for a resumption of the major upward trend that got underway in the second half of last year.

Print This Post

Print This Post