[This blog post is an excerpt from a TSI commentary]

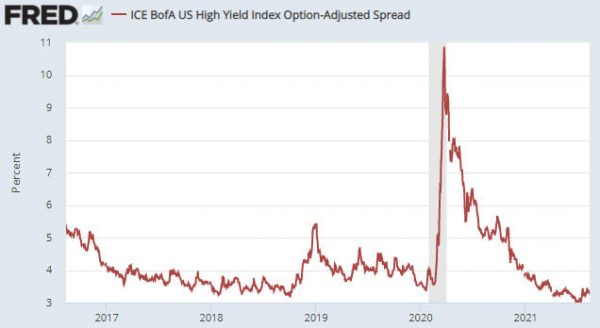

Our view has always been that as an organisation with unlimited power to create money out of nothing and with no rigid constraints on what it can buy with the money it creates, the Fed would never ‘run out of bullets’. The opposing view put forward by many financial-market analysts and commentators was that the Fed eventually would be overwhelmed by a virtual tidal wave of debt defaults and other deflationary forces.

The idea that the Fed could get overwhelmed by deflationary forces should have been killed by last year’s events, because the Fed proved that there were no lengths to which it would not go to prop-up equity prices, prevent widespread debt default and ensure that the US dollar continued to lose purchasing power. However, apparently it wasn’t. The view that deflation is on the horizon is not as popular as it once was, but it remains very much alive. We therefore wonder how far down the path of money destruction the Fed will have to go before smart people stop seeing deflation as the biggest threat. Unfortunately, over the next few years we are going to find out.

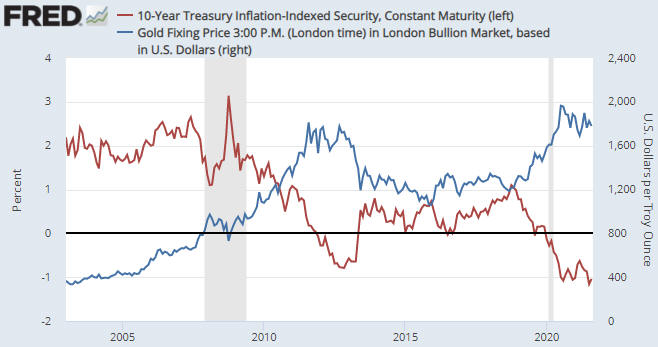

The US economy is immersed in a crisis-monetisation cycle, as are many other economies. In the US, a crisis or a deflation scare or a recession or even just a steep stock market decline prompts the Fed to start monetising assets, with the speed and magnitude of the monetisation ramping up until equity and consumer prices resume their long-term upward trends. This has been going on for decades and explains why the US stock market’s valuation keeps making higher highs and higher lows.

The big change over the past 18 months is that the US federal government has become more involved in promoting the perpetual price inflation, partly because there is political capital to be gained by taking actions that boost wages and partly because, at a superficial level at least, there have been no negative economic consequences to date associated with the massive increase in the government’s debt. The government’s actions are ensuring that the new money affects goods and services prices in addition to asset prices.

The crisis-monetisation cycle doesn’t end in deflation. The merest whiff of deflation just encourages central bankers and politicians to do more to boost prices. In fact, the occasional deflation scare is necessary to keep the cycle going. The cycle only ends when most voters see “inflation” as the biggest threat to their personal economic prospects.