It is worth paying close attention when a market trends into a period during which a turning point is likely based on historical cyclicality. The gold mining sector has just entered such a period.

We are referring to the strong tendency of the gold mining sector, as represented by the Gold Miners ETF (GDX), to make its high or its low for the year during August-September. Specifically, this period contained the low for the year in 2015, the high for the year in 2016 and 2017, the low for the year in 2018, the high for the year in 2019 and 2020, and the low for the year in 2021 and 2022. In other words, the August-September period ushered in the annual high or the annual low in each of the past eight years.

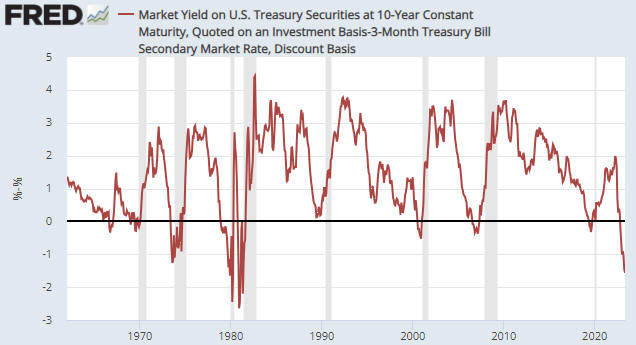

The vertical red lines on the following weekly GDX chart mark the aforementioned August-September turning points.

We have been following the gold mining sector’s August-September cycle at speculative-investor.com for several years now. At the start of a year there will be no way of knowing whether that year’s August-September period will contain an important high or low, but there usually will be clues by June. By mid-June of this year it was apparent that if the August-September cycle was still in effect then it would mark an important low, that is, a turn from down to up. Subsequent price action has continued to point to an August-September low.

The 12-month cycle low could be set at any time over the next few weeks, but to create maximum potential for the ensuing rally it ideally will be set after the March-2023 low has been tested or breached.

Print This Post

Print This Post