Some economists/analysts argue that the government creates wealth in the private sector via deficit-spending. From an accounting perspective they are right, in that when the government borrows and then spends X$ the private sector is left with the same amount of dollars plus an asset in the form of government debt securities worth X$. This implies that every dollar of government deficit-spending immediately adds a dollar to the private sector’s wealth, regardless of whether or not the spending contributes to the pool of real resources. This is counterintuitive. After all, given that every government is very good at deficit spending, there would be no poverty in the world if it really were possible for the government to create wealth in the private sector simply by putting itself further into debt. So, what’s the problem with the aforementioned accounting?

There are multiple problems, the first of which I’ll explain via a hypothetical case. Fred Smith is operating a basic Ponzi scheme. He is issuing $1,000 bonds that have a very attractive yield and using money from new investors to pay the interest on existing bonds and to finance a lavish lifestyle for himself. Using the same accounting that was used above to ‘explain’ how government deficit-spending creates wealth, every time Fred issues a new bond and spends the proceeds the total amount of wealth in the economy ex-Fred increases by $1,000.

The government is like Fred. For all intents and purposes, the government is running a Ponzi scheme because a) the interest and principal payments to existing investors are financed by issuing new debt, and b) there is no intent to ever pay-off the debt (the total debt increases every year). As was the case in the Fred example, every time the government issues a new bond and spends the proceeds the total amount of wealth in the economy ex-government increases by the amount paid for the bond.

Just as it would not make sense to view a dollar invested in Fred’s Ponzi scheme as having the equivalent effect on actual wealth as a dollar invested productively, it does not make sense to equate investment in government bonds with investment in productive assets.

That’s not the only problem, because if government bonds are purchased with existing money then an increase in government indebtedness must result in reduced investment in private sector debt or equity. In this case, therefore, government deficit-spending ‘crowds out’ private-sector investment, which is a problem in that politically-motivated spending by the government is likely to contribute less to the total pool of real wealth than economically-motivated spending by the private sector.

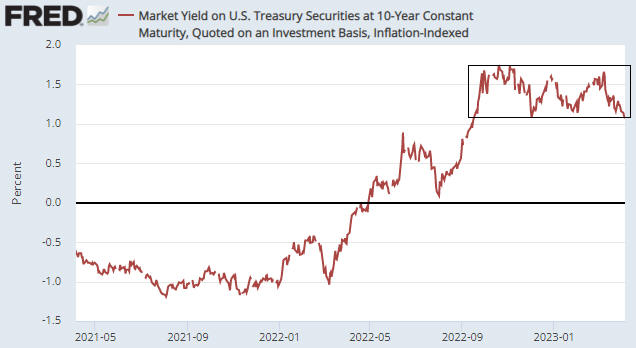

But what if government debt is purchased by the central bank or commercial banks with newly-created money, as occurs when the central bank implements a Quantitative Easing (QE) program? In this case there is no ‘crowding out’ of private sector investment.

According to MMT (Modern Monetary Theory) proponents as well as most Keynesians and Monetarists, the money supply increase that occurs when government debt is purchased using newly-created money is not a problem until/unless it leads to a large rise in the “general price level” as indicated by statistics such as the CPI. However, a rise in the general price level is not the only problem that can be caused by creating money out of nothing. It’s not even the main problem. The main problem is the distortions to interest rates and other price signals that the new money brings about. These distortions can lead to mal-investment on a grand scale.

In conclusion, sometimes a concept can be counterintuitive primarily because it is wrong. In accounting terms it can seem as if the government can ‘magically’ create wealth via deficit-spending, but only if you treat investment in government debt as equivalent to investment in productive endeavours and ignore the fact that creating money out of nothing tends to cause mal-investment.

Print This Post

Print This Post