In a 13th August blog post I noted that for the first time this year the sentiment backdrop had become decisively supportive of the gold price. I also noted that the fundamental backdrop remained unequivocally gold-bearish, and then attempted to answer the question: What will be the net effect of these counteracting forces? My answer was that regardless of sentiment there could not be an intermediate-term upward trend in the gold price until the fundamentals turned gold-bullish, but a $100 short-term rebound was possible even without a significant fundamental improvement. What’s the current situation?

The current situation is similar. Since my 13th August post the sentiment backdrop has become slightly more bullish, the fundamental backdrop has become slightly more bearish, and the price is roughly unchanged at around $1200. Therefore, it’s fair to say that the battle between bearish fundamentals and bullish sentiment has been a draw thus far.

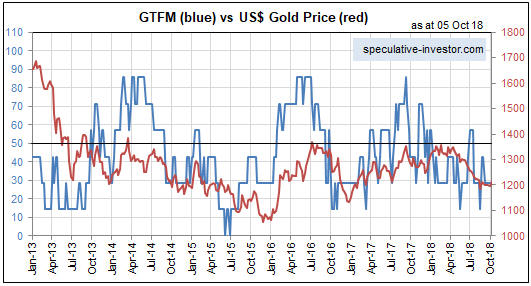

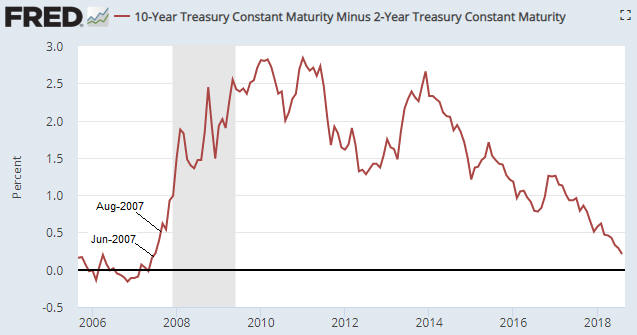

Just to recap, the most important fundamental drivers of the US$ gold price are credit spreads, the yield curve, the real interest rate (the TIPS yield), the relative strength of the banking sector, the US dollar’s exchange rate, the bond/dollar ratio and the general trend of commodity prices. These are the inputs to my Gold True Fundamentals Model (GTFM), a chart of which is displayed below.

Apart from a short period from late-June to mid-July when it was ‘whipsawed’, the GTFM has been continuously bearish since mid-January. No wonder the gold market has struggled this year.

The upshot is that due to the bullish sentiment a bounce in the gold price of up to $100 is still a realistic short-term possibility, but due to the bearish fundamentals a much larger rally is not.

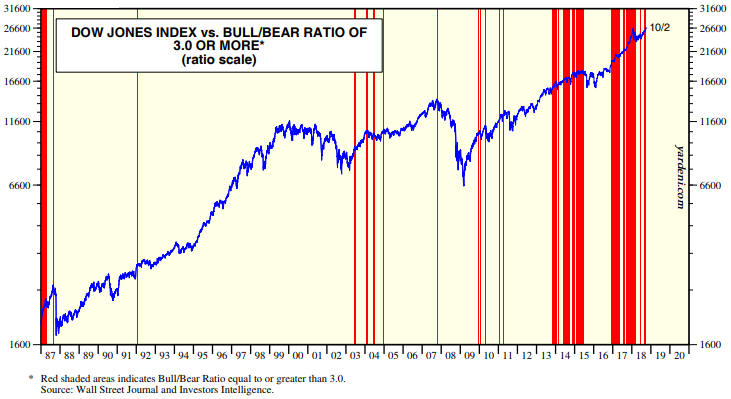

The fundamental backdrop is always shifting, so the fact that it is gold-bearish right now doesn’t mean that it will remain so for a long time to come. For example, additional weakness in the stock market would improve gold’s true fundamentals if it caused a significant decline in economic confidence and fostered the belief that the Fed will put its rate-hiking program on hold. However, until/unless such a shift happens, expectations regarding gold’s short-term prospects should be modest.

Print This Post

Print This Post