[This blog post is an excerpt from a TSI commentary published last week]

The phenomenal rise in the US monetary inflation rate from early-2020 to early-2021 set in motion an economic boom. There remains some doubt as to whether the boom is over, but the weight of evidence indicates that it probably is.

Booms contain the seeds of their own destruction, meaning that a painful economic bust becomes inevitable after there has been sufficient monetary inflation to foster a boom. Usually, the boom begins to unravel after the pace at which new money is being created (loaned into existence by commercial banks and/or electronically ‘printed’ by the central bank) drops below a critical level, but note that the bust phase cannot be postponed indefinitely by maintaining a rapid level of money-supply growth. On the contrary, an attempt to keep the boom going via an ever-increasing pace of money creation will cause the eventual bust to be the hyper-inflationary kind, which is the worst kind because it crushes the prudent along with the imprudent.

Over the past few decades a boom-to-bust transition for the US economy didn’t begin until after the monetary inflation rate (the year-over-year True Money Supply (TMS) growth rate) dropped below 6%. However, due to the structural damage to the economy resulting from the Fed’s manipulations of money and interest rates over many decades and especially over the past decade, it’s possible that this time around a bust will begin with the monetary inflation rate at a higher level than in the past. That is, even though the latest money-supply figures* reveal that the year-over-year TMS growth rate remains slightly above the 6% boom-bust threshold (refer to the monthly chart below), it’s possible that the US economy has entered the bust phase of the cycle.

Actually, it’s LIKELY that the US economy has entered the bust phase. This is because even though the monetary inflation rate has not yet dropped below our boom-bust threshold, it has dropped far enough to bring about a significant widening of credit spreads and cause the 10Y-2Y yield-spread to become inverted briefly in early-April.

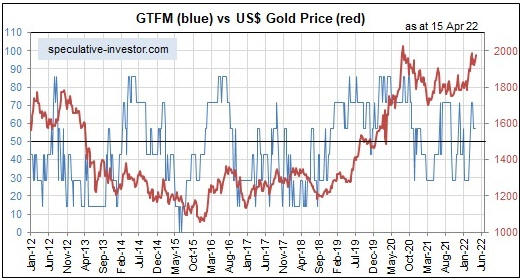

The most important boom-bust timing indicator that is yet to signal an end to the boom is the gold price relative to the prices of industrial metals such as copper. As illustrated by the following chart, since peaking last October the copper/gold ratio has chopped around at a high level. It must make a sustained break below its March-2022 low to signal the sort of relative strength in gold that would be consistent with the bust phase of the cycle.

*The Fed published the money-supply data for March-2022 on Tuesday 26th April.