[This blog post is a excerpt from a recent TSI commentary]

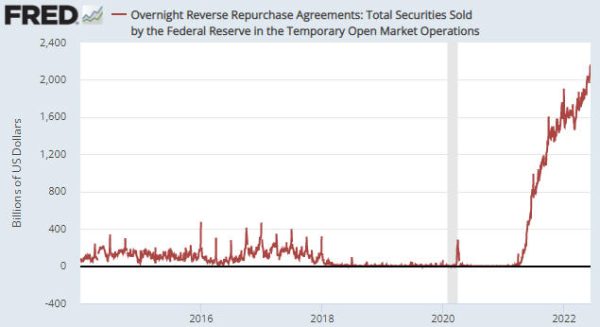

In terms of effect on the money supply, reverse repurchase agreements (reverse repos) are the opposite of quantitative easing (QE). Whereas every dollar of QE adds one dollar to the money supply plus one dollar to bank reserves at the Fed (bank reserves are not counted in the money supply), every dollar of reverse repos subtracts one dollar from the money supply plus one dollar from bank reserves at the Fed. Consequently, although reverse repos are not done with the primary aim of tightening monetary conditions, they effectively are a form of quantitative tightening (QT).

Unlike QE, reverse repos are temporary. To be more specific, the money removed from the banking system via a reverse repo will be returned within 24 hours unless a new reverse repo is created to replace the expiring one. However, the following chart shows that since April of last year the Fed has not only been rolling over or replacing expired reverse repos, but also has been adding to the outstanding pile by creating new reverse repos. As a result, the outstanding pile of reverse repos now amounts to $2.16 trillion. This means that the Fed’s reverse repo program has removed $2.16 trillion from the US economy since the beginning of April-2021.

From April-2021 until March-2022 the Fed was adding money to the economy via QE and simultaneously removing money from the economy via reverse repos. The amount of money being added via QE was greater than or equal to the amount being subtracted via reverse repos until early-December of last year, at which time the Fed became a net subtractor from the US money supply and US bank reserves.

One implication is that even though the Fed officially won’t start QT until this month, for all intents and purposes QT has been happening for about six months. Another implication is that the Fed now has more than two trillion dollars that it could inject into the economy simply by allowing existing reverse repos to expire. This could enable the Fed to boost the money supply over the months ahead while pretending to do QT.