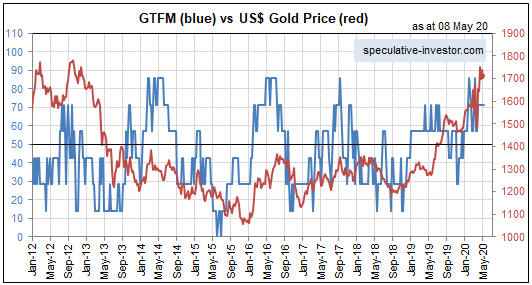

Gold market sentiment is complicated at the moment. There are signs of speculative froth, but at the same time the total speculator net-long position in Comex gold futures is close to its low for the year despite the US$ gold price recently hitting an all-time high. A likely explanation is that large speculators are focusing more on gold ETFs than on gold futures.

The price of a gold ETF that holds physical gold will track the gold price automatically. Therefore, there never will be an increase in the amount of gold held by such an ETF unless bullish speculators become sufficiently enthusiastic to push the market price of the ETF above its net asset value (NAV). When this happens it creates an arbitrage opportunity for the ETF’s Authorised Participants (APs), which results in the addition of gold bullion to the ETF’s inventory.

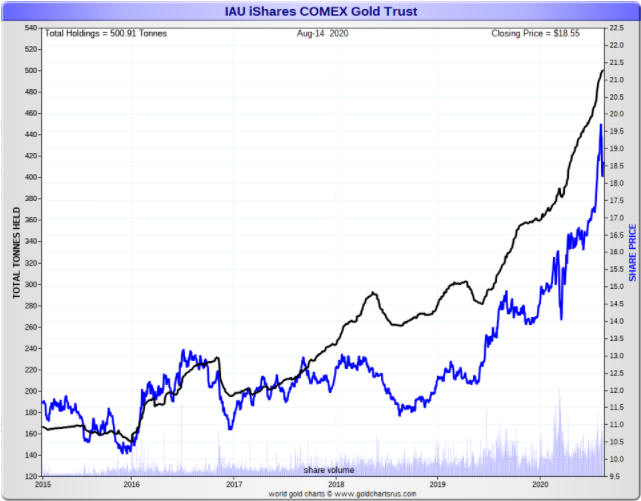

The following charts from http://www.goldchartsrus.com/ show large gains in the amounts of physical gold held by GLD and IAU, the two most popular gold ETFs. Specifically, the charts show that about 400 tonnes (12M ounces) of gold was added to the combined GLD-IAU inventory over the past few months. This actually isn’t a huge amount within the context of the global gold market, but it points to aggressive buying of the ETFs.

In other words, the evidence of gold-related speculative froth is in the stock market rather than the futures market.

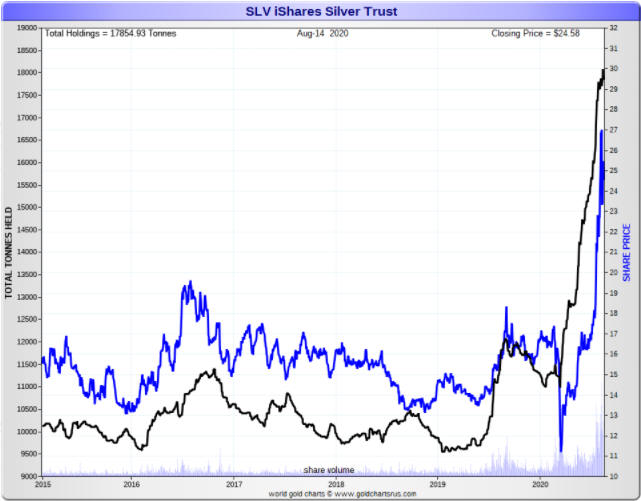

The next chart shows that the silver story is similar. Specifically, the chart shows that about 7,000 tonnes (220M ounces) of physical silver have been added to the inventory of the iShares Silver ETF (SLV) since the March-2020 price low, including about 1,900 tonnes (60M ounces) during the three-week period culminating at the early-August price high.

The fundamental backdrop remains supportive for gold and silver, but sentiment suggests that a multi-month price top was put in place in early-August or will be put in place via a final spike within the next three weeks.

Print This Post

Print This Post