[Here is a brief excerpt from a commentary published at www.speculative-investor.com on 21st April 2024]

Gold recently became extremely overbought in momentum terms against ALL major fiat currencies. For example, the following daily charts show that based on the daily RSI(14), a momentum indicator included at the bottom of each chart, gold recently became as stretched to the upside as it was at any time over the past 15 years, including at the 2011 major peak, relative to the euro, the Yen, the Swiss franc, the Australian dollar and the Canadian dollar. Looking at it from a different angle, in momentum terms the euro, the Yen, the Swiss franc, the Australian dollar and the Canadian dollar recently became as stretched to the downside relative to gold as they have been at any time over the past 15 years.

Against the US$ gold did not become quite as stretched to the upside in momentum terms, because the US$ recently weakened by less than the other major currencies.

With gold having just hit a rare overbought extreme against all major fiat currencies, the probability is high that the gold price has either just set a multi-month price top or will soon do so. For two main reasons, however, it’s unlikely that the April-2024 extreme will mark the end of the cyclical rise in the gold price (meaning: the end of the cyclical decline in fiat currency).

The first reason is sentiment as indicated by the COT data, which still shows a healthy degree of speculator scepticism. Of particular relevance, despite gold’s spectacular recent price rise the collective net-long position of small traders (the proverbial dumb money) in gold futures remains not far from a 14-month low.

The current sentiment situation suggests that there is still a lot of scope for speculator long accumulation.

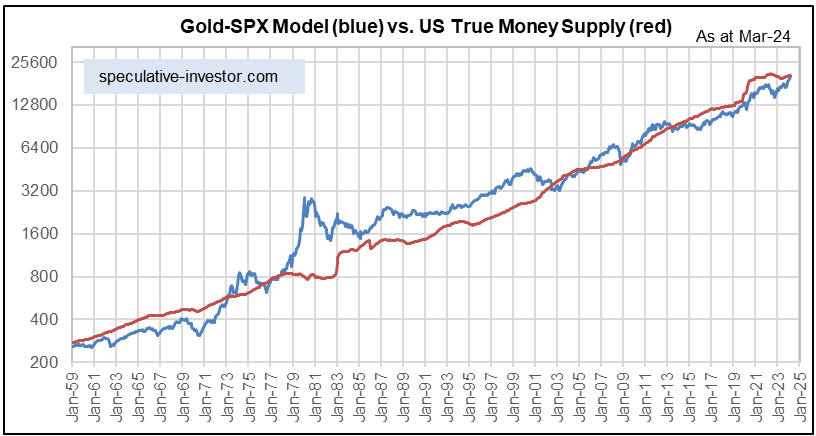

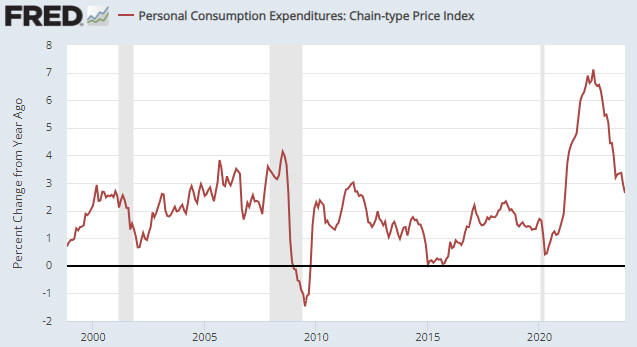

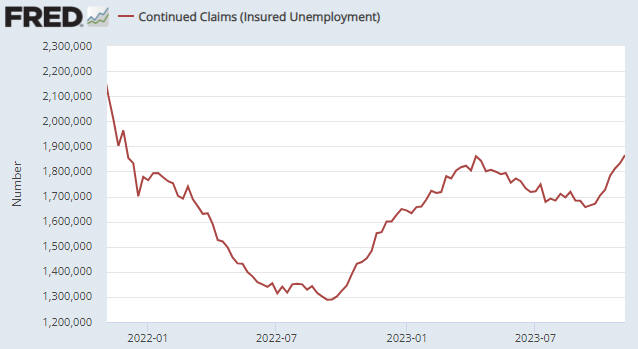

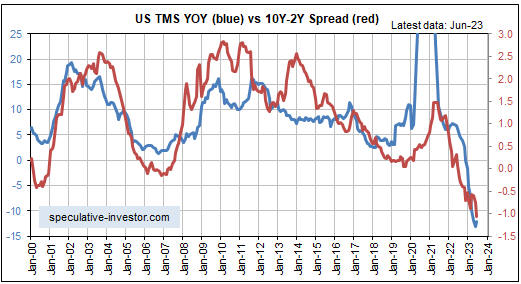

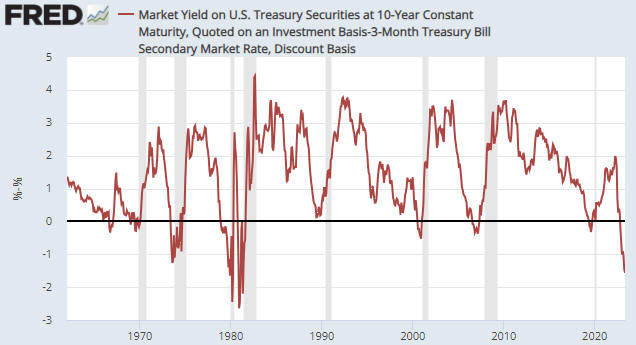

The second reason is the high probability that the fundamental backdrop as indicated by our Gold True Fundamentals Model (GTFM) will shift in gold’s favour over the next several months.

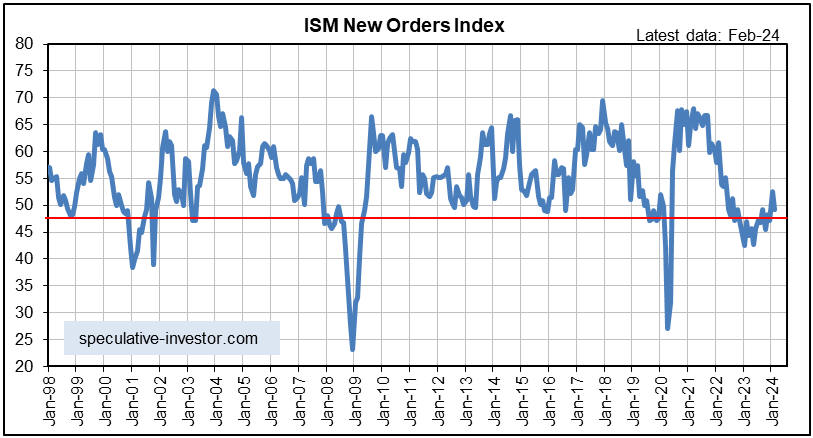

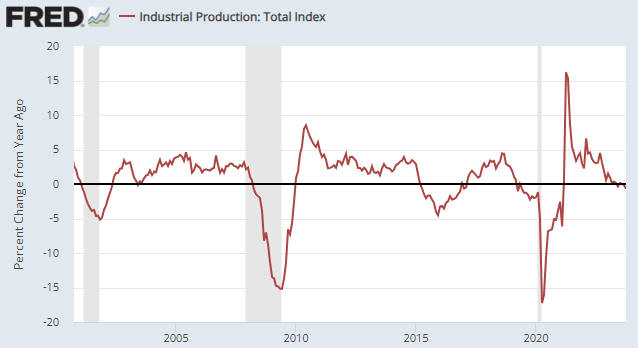

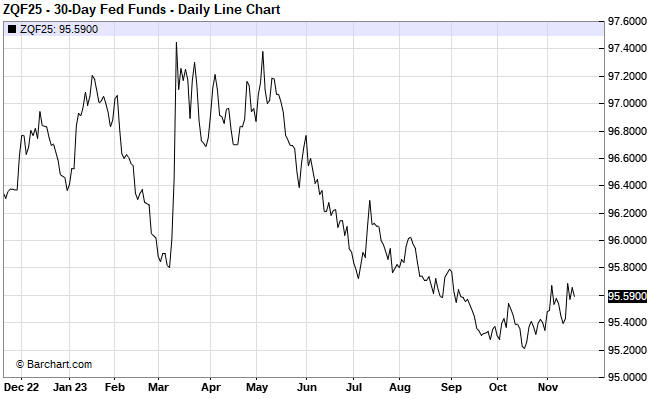

The GTFM turned bearish during the week before last due to a rise in the 10-year TIPS yield (a real interest rate proxy), but it returned to neutral last week due to the breakdown in the XLY/XLP ratio mentioned in the Stock Market section of today’s report. It stands a good chance of turning bullish in the not-too-distant future, because 1) a shift within the stock market from risk-on to risk-off has been confirmed, 2) US economic data probably will have a weakening trend, 3) the Fed (meaning: Powell) is looking for an excuse to loosen monetary policy, and 4) the Biden administration will be ‘pulling out all stops’ to make the economy appear healthy during the lead-up to the November-2024 election.

Print This Post

Print This Post