[This blog post is a brief excerpt from a TSI commentary published last week]

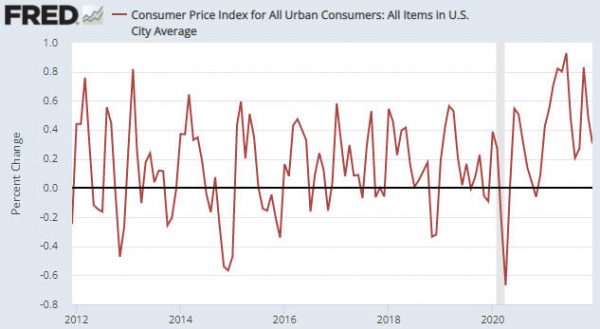

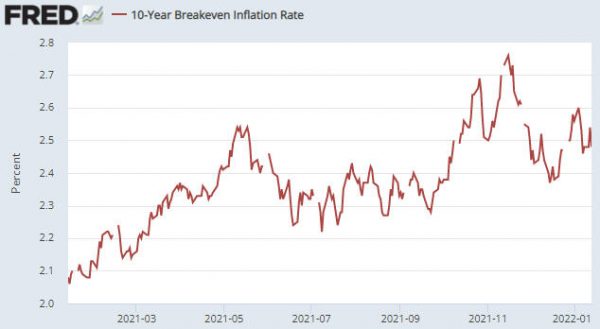

It was reported on Wednesday 12th January that the year-over-year growth rate of the US CPI hit a new post-1982 high of 7% in December-2021. However, garnering less attention was the fact that the month-over-month CPI growth rate peaked in June-2021, made a slightly lower high in October-2021 and in December-2021 was not far from its low of the past 12 months. The first of the following charts shows the month-over-month change in the US CPI. Of greater importance for financial market participants, the second of the following charts shows that inflation expectations (the rate of CPI growth factored into the Treasury Inflation Protected Securities market) is well down from its November-2021 peak and actually fell on Wednesday 12th January in the wake of the horrific headline CPI news.

We were very bullish on “inflation” back in April of 2020 when deflation fear was rampant; not because we were being contrary for the sake of being contrary but because central bank and government actions pretty much guaranteed that the CPI would be much higher within 12 months. Now, with inflation fear rampant, we expect to see increasingly obvious signs over the quarters ahead that the inflation threat has abated, not because we are being contrary for the sake of being contrary but because the monetary and fiscal situations stopped being pro-inflation many months ago.

It’s likely that the next round of accelerating inflation will emerge during 2023-2024.

Print This Post

Print This Post