Like old soldiers, old beliefs never die. In the financial world, one of the many old beliefs that clings to life despite a pile of conflicting evidence is the one about gold being primarily a hedge against, or a play on, so-called “CPI inflation”.

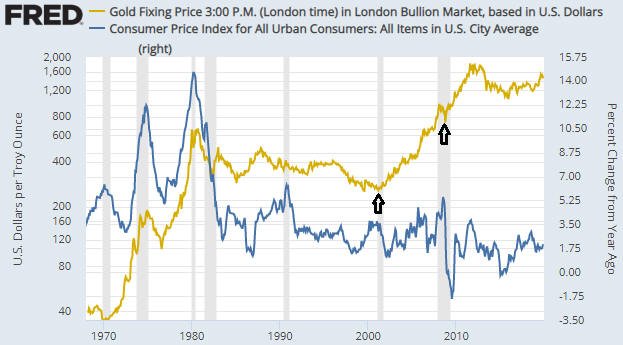

The belief that big moves in the gold price are primarily driven by “price inflation” as measured by the CPI was spawned by what happened during 1972-1982. As illustrated by the following chart, there was a strong positive correlation between the gold price and the 12-month rate of change in the CPI during this period. However, it is clear that the positive correlation of 1972-1982 did not persist over the subsequent 37 years. In particular, the chart shows that the most recent two major rallies in the gold price (the rallies that began in early-2001 and late-2008) had nothing to do with “CPI inflation”. These rallies got underway in the midst of steep declines in the CPI’s growth rate and were at no time supported by a rapidly-rising CPI. The chart also shows that 2019′s significant up-move in the gold price had nothing to do with a rising rate of “CPI inflation”.

All substantial gold rallies are driven by falling confidence in the monetary authorities. The fall in confidence can be associated with so-called “price inflation”, but it certainly doesn’t have to be. As was the case with the major gold rallies that began in 2001 and 2008, it can be associated with stock market weakness, concerns about future economic growth, stresses in the banking system and minimal “price inflation”.

At some point within the next 10 years there could be a major bullish trend in the gold price that is linked to a large rise in the CPI, but that’s not the most likely scenario. There’s a better chance that the next major gold rally will be set in motion by a long-term trend reversal in the US stock market. In fact, even the gold bull market of the 1970s had more to do with a long-term bearish trend in US equities (the US stock market peaked in the late-1960s and bottomed in 1982) than rapid “price inflation”.

Naturally, the US$ gold price will rise over very long (50+ year) periods as the US$ depreciates, but so will the US$ prices of many other assets. Within this group of assets that tend to rise in terms of depreciating currency over the very long term, gold’s unique property is its counter-cyclicality. Gold racks up the bulk of its long-term appreciation during the bust phases of economic cycles.

Print This Post

Print This Post