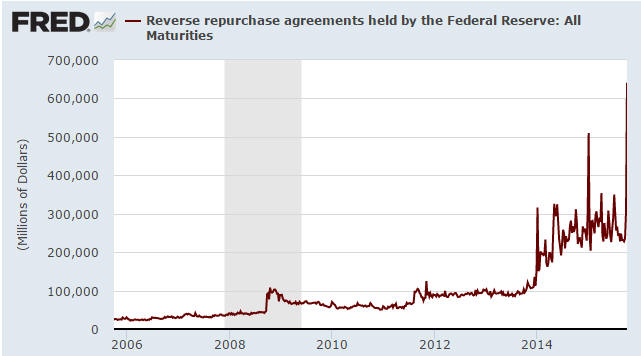

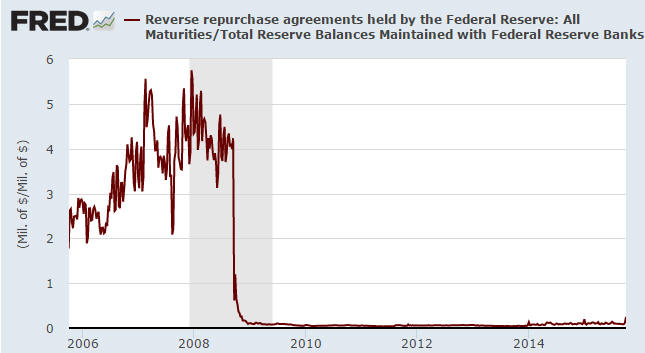

Last week I wrote about the incorrect portrayal of the late-September spike in the Fed’s “Reverse Repo” (RRP) operations. Breathless commentary in some quarters had portrayed the RRP spike as an attempt by the Fed to ward-off a crisis, which didn’t make sense. One of the main reasons it didn’t make sense is that a reverse repo takes money OUT of the banking system and is therefore the opposite of what the Fed would be expected to do if it were trying to paper-over a financial problem.

I subsequently saw an article by Lee Adler that provides some more information about the RRP spike. If you are interested in the real reasons behind it then you should read the afore-linked article, but in summary it has to do with a “Fed stupid parlor trick and the temporary shortage of short term T-bills along with the resulting excess of cash.”

According to Mr. Adler: “The two salient facts are that the Fed regularly does two quarter end term repo operations that add to the end of quarter amounts outstanding. They are not a response to any market conditions. The Fed reveals in its FOMC meeting minutes and elsewhere that it instructs the NY Fed to conduct these quarter end operations. It has done so every quarter this year. The NY Fed posts a statement laying out the operations a few days in advance of the end of the quarter.”

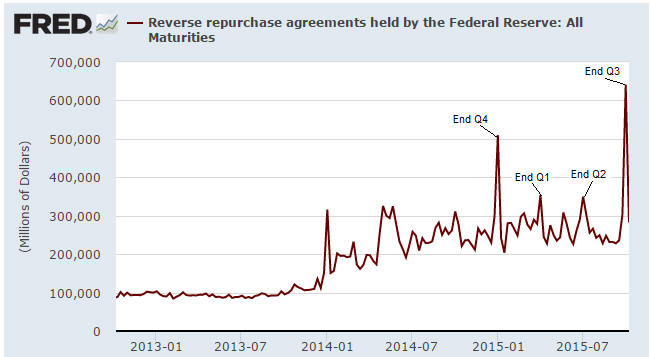

I’ve indicated the quarter-end RRP spikes on the following chart. The latest quarterly spike was larger than the preceding three due to the fact that the weekly update of the Fed’s balance sheet happened to be published on the day after the end of the September quarter. Notice that the volume of outstanding RRPs plunged during the first week of the new quarter.

If the pattern continues then there will be another RRP spike during the final week of December, regardless of what’s happening in the financial world at the time.