[This blog post is an abbreviated excerpt from a recent commentary published at www.speculative.investor.com]

On Friday of last week the Supreme Court of the United States (SCOTUS) ruled against the tariffs imposed by Trump under the International Emergency Economic Powers Act (IEEPA). What will be the financial-market and economic effects?

Based on the financial world’s initial reaction, the effects will be relatively minor. For example, the following weekly chart shows that the iShares 20+ Year Treasury ETF (TLT) consolidated last week but held the preceding week’s upside breakout. Also, the currency market did very little in response to the news.

The small initial market reaction probably stems from the fact that the Trump Administration intends to replace the tariff revenues lost through the inability to use the IEEPA with tariff revenues gained through other avenues, such as “Section 122”. In fact, Trump already has stated that he will use Section 122 to impose a global 15% (initially 10% but raised to 15% one day later) tariff on US imports. This would keep total tariff revenue at around the same level, but it would change substantially the distribution of the tariffs. For example, the average tariff on imports from China would be reduced, but the average tariff applied to imports from Canada would increase.

The single biggest problem associated with Trump’s use of tariffs has been the uncertainty resulting from the sudden changes. The uncertainty remains, because there will be many changes to product tariff rates in response to last Friday’s SCOTUS ruling, necessitating changes to many business plans. Furthermore, the President’s authority under Section 122 only enables the imposition of tariffs for up to 150 days. What happens after that?

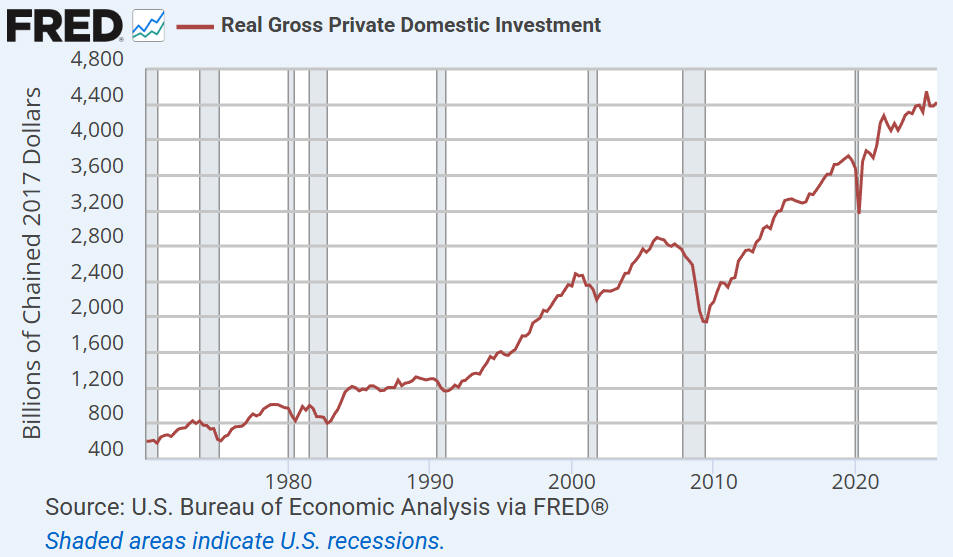

Trump has been fortunate in that the business investment that has been curtailed/delayed by his many tariff-related threats and policy flip-flops has coincided with a massive increase in investment associated with AI — investment that would have happened regardless of who was in the White House. As illustrated by the following quarterly chart, Real Gross Private Domestic Investment (RGPDI) in the US has dropped from its Q1-2025 all-time high, but not by much. Moreover, with at least US$1 trillion of AI-related investment slated to occur during 2026 in an economy with a current RGPDI run-rate of about US$4.4 trillion, there’s a good chance that RGPDI will make a new all-time high within the next three quarters despite the uncertainty caused by the tariffs.

Unfortunately, this AI-related investment binge won’t do anything for average Americans other than increase their electricity costs and make their jobs less secure.

Summing up, last Friday’s ruling on Trump’s tariffs has removed a ‘known unknown’, but it has created new unknowns and hasn’t prompted a change to our outlook for any market. Currently, the ‘known unknown’ with the largest potential short-term market impact is the US-Iran situation.