1. According to news reports, unnamed senior government officials in China have recommended slowing or halting the purchase of US Treasury securities.

2. If China’s government really was planning to reduce its investment or rate of investment in US government debt, why would it announce the change beforehand given that doing so would potentially lower the market value of its holdings?

3. The only reason to make the announcement is if there is no intention to implement a change but there is something to be gained by making the threat.

4. Clearly, the announcement is part of a negotiation strategy regarding China-US trade.

5. The reality is that China’s government buys and sells Treasury securities and other international reserve assets as part of its effort to manage (that is, manipulate) the Yuan’s exchange rate. When the Yuan is strengthening, international reserves will be bought — using newly-created local currency — to slow or stop the advance. When the Yuan is weakening, international reserves will be sold to slow the decline. That’s why China’s stash of US Treasury debt trended upward for many years prior to 2014 (when the Yuan was strengthening relative to the US$), trended downward during 2014-2016 (when the Yuan was weakening relative to the US$), and trended upward over the past 12 months (when the Yuan was strengthening relative to the US$).

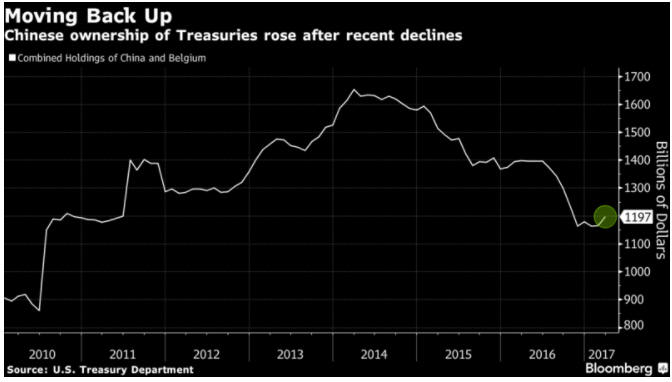

6. China’s total investment in US Treasury securities was significantly greater 4 years ago than it is today. This is evidenced by the following chart, which shows that the combined Treasury holdings of China and Belgium (Belgium must be added to get the complete picture because that’s where China’s government keeps its custodial accounts) dropped from about 1.65 trillion in early-2014 to 1.2 trillion in May-2017. It’s likely that the holding is now about $100B larger, which implies that China’s government has been a net seller of about $350B of Treasury debt over the past four years.

7. China’s government will continue to do what it has been doing — buy US Treasury debt when it feels the need to weaken the Yuan and sell US Treasury debt when it feels the need to strengthen/support the Yuan.

8. There are good reasons to expect that yields on US T-Bonds and T-Notes will be significantly higher in 6 months’ time, but the recent deliberately-misleading news emanating from China is not one of them.

Print This Post

Print This Post