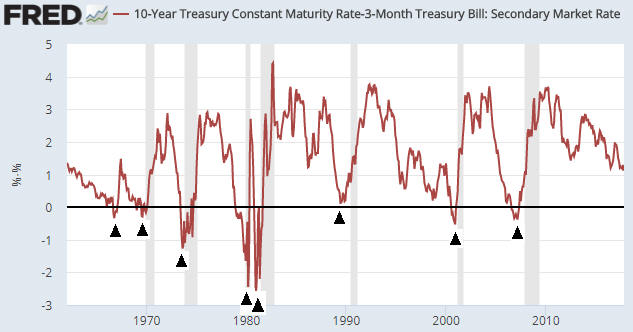

A popular view is that a new cyclical gold bull market commenced in December-2015. If so, the gold bull is now two years old. At the same time, the following weekly chart shows that the gold/SPX ratio (the US$ gold price divided by the S&P500 Index) recently made a 10-year low. Is it possible for gold to be hitting 10-year lows relative to the SPX two years into a gold bull market?

If the sole measuring stick is a depreciating currency then the answer is yes, but if a more practical measuring stick is used then the answer is no.

I explained in an earlier blog post that for a bull-market definition to be practical it must take into account the fact that what people really want from an investment is an increase in purchasing power, not just an increase in price. Unfortunately, it isn’t possible to accurately determine how an investment is doing in purchasing-power terms, but a reasonable alternative is to eliminate the poor measuring stick known as fiat currency from the equation by looking at the performances of different investments relative to each other. The ones that are in bull markets are the ones that are relatively strong.

The definition I arrived at was: An investment is in a bull market if it is in a multi-year upward trend in nominal currency terms AND relative to its main competition.

As also explained in the post linked above, measuring one market against another works especially well for gold bullion and the SPX. This is because they are effectively at opposite ends of an investment seesaw, with the SPX doing best when confidence in money, central banking and government is rising and gold doing best when confidence in money, central banking and government is falling.

I think that it makes no sense to define what happened since December-2015 as a gold bull market. I also think that it is important not to get hung up on bull/bear labels. Bull market or not, January through August of 2016 was a great time to own gold-mining stocks. And bull market or not, the period since August-2016 has been a not-so-great time to be heavily invested in gold-mining stocks.

Rather than being committed to the theory that a gold bull market began in December-2015 or the opposing theory that a gold bear market remains in force, it is better to use sentiment, price action and fundamentals to identify good buying and good selling opportunities in real time.

Print This Post

Print This Post