The Commitments of Traders (COT) reports are nothing other than sentiment indicators, but as far as sentiment indicators go they are among the most useful. In fact, for some markets, including gold, silver, copper and the major currencies, the COT reports are by far the best indicators of sentiment. This is because they reflect how the broad category known as speculators is betting. Sentiment surveys, on the other hand, usually focus on a relatively small sample and are, by definition, based on what people say rather than on what they are doing with their money. That’s why for some markets, including the ones mentioned above, I put far more emphasis on the COT data than on sentiment surveys.

In this post I’m going to summarise the COT situations for four markets with the help of charts from an excellent resource called “Gold Charts ‘R’ Us“. I’ll be zooming in on the net positions of speculators in the futures markets, although useful information can also be gleaned from gross positions and the open interest.

Note that what I refer to as the total speculative net position takes into account the net positions of large speculators (non-commercials) and small traders (the ‘non-reportables’) and is the inverse of the commercial net position. The blue bars in the middle sections of the charts that follow indicate the commercial net position, so the inverse of each of these bars is considered to be the total speculative net position.

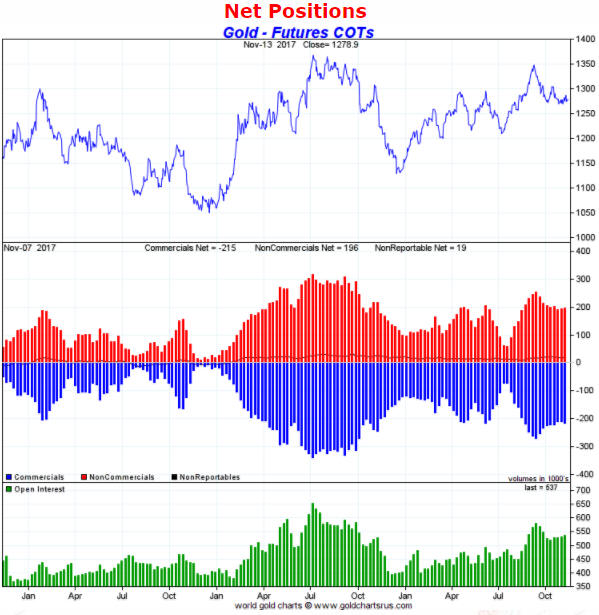

Let’s begin with the market that most professional traders and investors either love or hate: gold.

The following weekly chart shows that the total speculative net-long position in Comex gold futures hit an all-time high in July of 2016 (the chart only covers the past three years, but I can assure you that it was an all-time high). In July of last year the stage was therefore set for a sizable multi-month price decline, which unfolded in fits and starts over the reminder of the year. More recently, the relatively small size of the speculative net-long position in early-July of this year paved the way for a tradable rebound in the price, but by early-September the speculative net-long position had again risen to a relatively high level. Not as high as it was in July of 2016, but high enough that it was correct to view sentiment as a headwind.

There has been a roughly $100 pullback in the price from its early-September peak, but notice that there has been a relatively minor reduction in the total speculative net-long position. This suggests that speculators have been stubbornly optimistic in the face of a falling price, which is far from the ideal situation for anyone hoping for a gold rally. A good set-up for a rally would stem from the flushing-out of leveraged speculators.

The current COT situation doesn’t preclude a gold rally, but it suggests that a rally that began immediately would be limited in size to $50-$100 and limited in duration to 1-2 months.

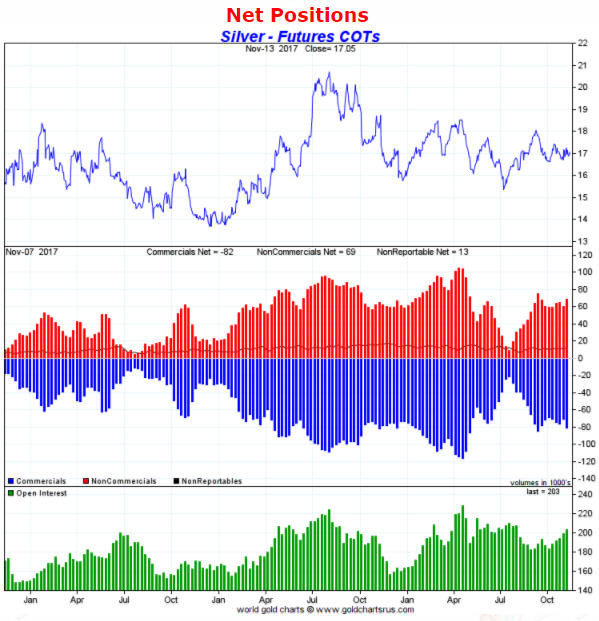

It’s a similar story with silver, in that the price decline of the past two months has been accompanied by almost no reduction in the total speculative net-long position in Comex silver futures. In other words, silver speculators are tenaciously clinging to their bullish positions in the face of price weakness. This suggests a short-term risk/reward that is neutral at best.

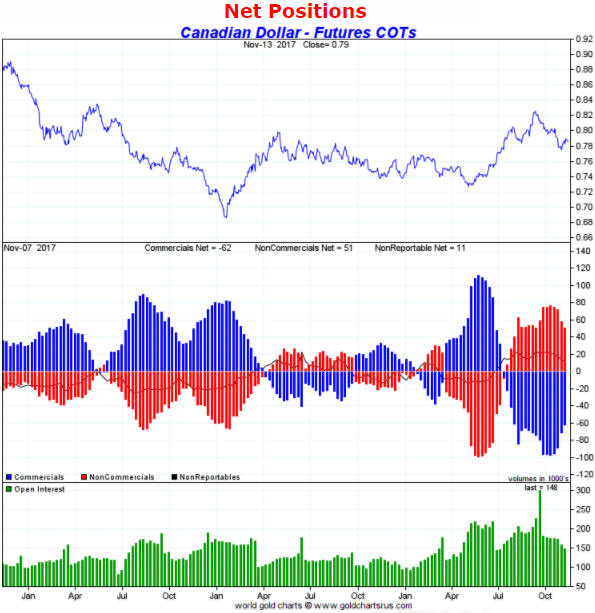

In May of this year the total speculative net-short position in Canadian dollar (C$) futures hit an all-time high, meaning that the C$’s sentiment situation was more bullish than it had ever been. This paved the way for a strong multi-month rally, but by early-September the situation was almost the exact opposite. After having their largest net-short position on record in May, by late-September speculators had built-up their largest net-long position in four years. The scene was therefore set for C$ weakness.

The speculative net-long position in C$ futures has shrunk since its September peak but not by enough to suggest that the C$’s downward correction is complete.

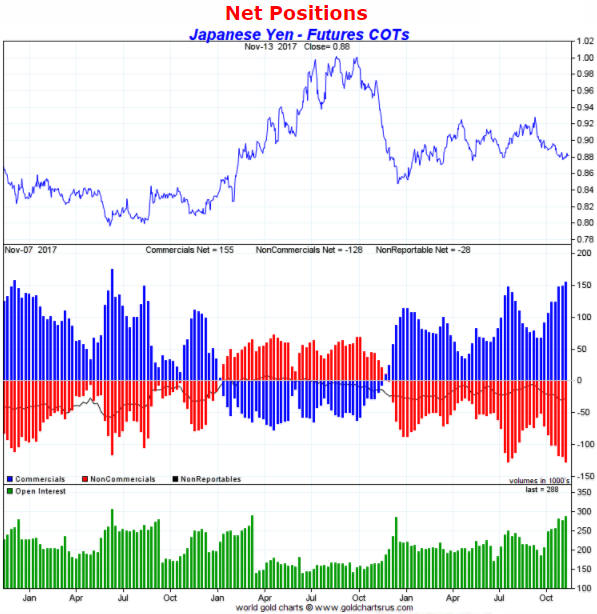

For the Yen, the sentiment backdrop is almost as supportive as it gets. This is because the speculative net-short position in Yen futures is not far from an all-time high. There are reasons outside the sentiment sphere to suspect that the Yen won’t be able to manage anything more than a minor rebound over the coming 1-2 months, but due to the supportive sentiment situation the Yen’s short-term downside potential appears to be small.

Needless to say (but I’ll say it anyway), sentiment is just one piece of a big puzzle.

Print This Post

Print This Post