This post is a slightly-modified excerpt from a recent TSI commentary.

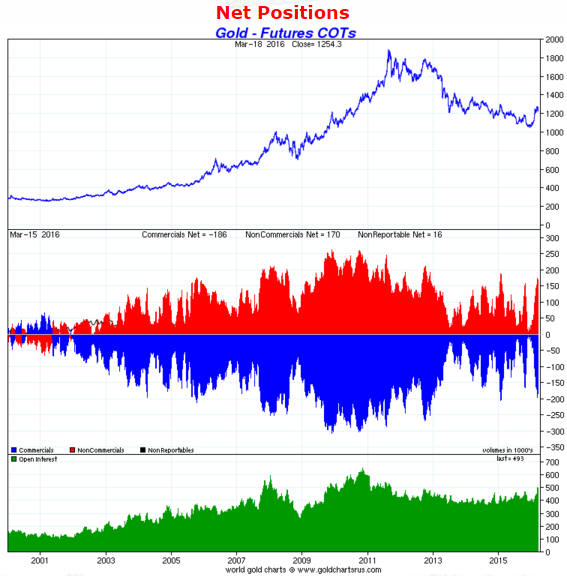

The COT (Commitments of Traders) data for gold is portrayed by some commentators as an us-versus-them battle, with “them” (the bad guys) being the Commercials. Whether this is done out of ignorance or because it makes a good story that attracts readers/subscribers, it paints an inaccurate picture.

As I’ve explained in numerous TSI commentaries over the years, the Commercial position is effectively just the mathematical offset of the Speculative position. Speculators, as a group, cannot go net-long by X contracts unless Commercials, as a group, go net-short by X contracts. Furthermore, we can be sure that Speculators are the drivers of the process because most of the time the Speculative net-long position moves in the same direction as the price.

With Speculators becoming increasingly long as the price rises, it will always be the case that the Speculative net-long position will be near a short-term maximum when the price is near a short-term high. This means that the Commercial net-short position must always be near a short-term maximum when the price is near a short-term high, creating the false impression that the Commercials are always right at price tops.

The reality is that the Commercials are neither right nor wrong, since they generally don’t bet on price direction. In some cases they are selling-short the futures to hedge long positions in the physical, but in the gold market the dominant Commercials are the bullion banks that trade spreads between the physical and futures. If trading and other costs are low enough and volumes are high enough, the bullion banks can guarantee themselves profits — regardless of subsequent price direction — by buying/selling gold for future delivery and simultaneously selling/buying the physical metal.

Consider, for example, the situation where Speculators increase their collective demand for gold futures. If this additional Speculative demand causes the futures price to rise relative to the spot price it can create an opportunity for a bullion-bank Commercial to simultaneously sell the futures and buy the physical, thus locking-in a profit equal to the spread (between the futures price and the spot price) less the costs of storage, insurance and financing. At a time when the official interest rate is near zero, even a tiny futures-physical spread in the gold market can create the opportunity for a profitable trade.

I’m going back over this old ground to make sure that TSI readers aren’t taken-in by the popular, but wrongheaded, conspiracy-centric us-versus-them characterisation of the COT information.

Print This Post

Print This Post