Jordan Roy-Byrne recently posted an interesting video discussing gold’s Commitments of Traders (COT) data. The video was a response to numerous articles warning that the COT situation was flashing a danger signal. I agree with Jordan’s interpretation, which is that the COT data are probably not predicting a large decline in the gold price.

The main point of the above-linked video is similar to a point I’ve made numerous times in TSI commentaries over the years. The point is that there are no absolute benchmarks when it comes to sentiment indicators in general and the COT situation in particular (the COT reports are nothing more than sentiment indicators). A level that constitutes an ‘overbought’ warning in a bear market will usually not be applicable in a bull market, in that during a multi-year bullish trend the market will tend to become more ‘overbought’ and stay ‘overbought’ for longer. Of particular relevance, the speculative net-long position in gold futures that coincides with a short-term price top will generally reach much higher levels during a bull market than during a bear market. In fact, by the time a bull market has been in progress for 2-3 years the levels that marked short-term ‘overbought’ extremes during the preceding bear market could now mark short-term ‘oversold’ extremes.

In other words, sentiment must be considered within the context of the long-term price trend.

Unfortunately, in the early part of a new long-term trend there is usually no way to know, for sure, that the trend has changed. In gold’s case there is evidence that a cyclical bull market has begun, but the evidence is not yet conclusive. That’s why it is prudent to take information such as the COT data at face value.

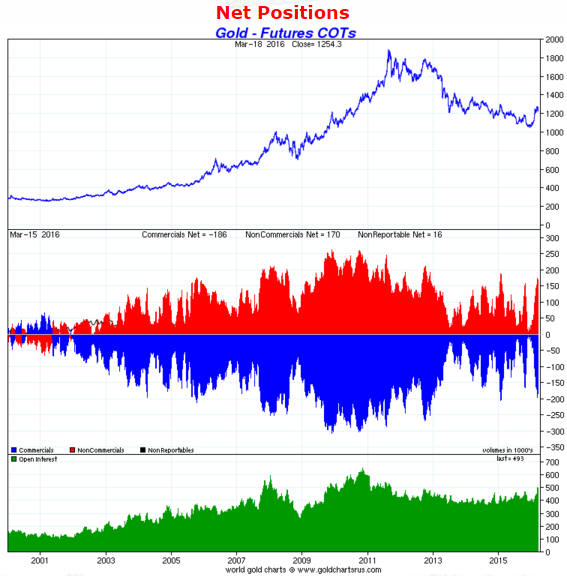

I view gold’s current COT situation, which is reflected on the following chart from Sharelynx.com, as a valid warning that short-term downside risk is at least as high as the remaining short-term upside potential. At the same time I realise that if gold has entered a new cyclical bull market then the speculative net-long position (the red bars on the chart) is going to get much larger within the coming two years.

Print This Post

Print This Post