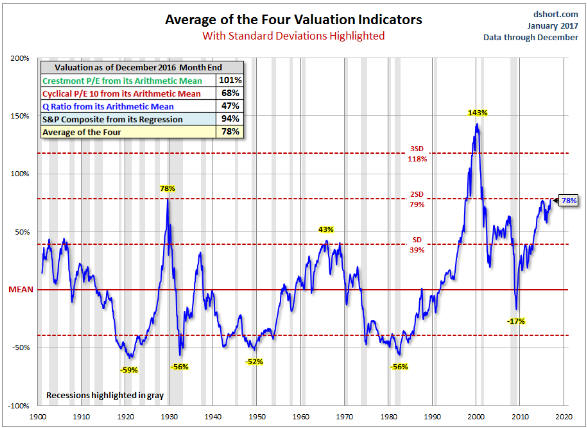

In a blog post last Friday I provided evidence that the extent to which a US president is “pro-business” has very little to do with the stock market’s performance during that president’s term in office. Regardless of whether the associated policies are good or bad for the economy, the key to the stock market’s performance over the course of a presidency is the market’s position in its long-term valuation cycle. On this basis there’s a high probability that the stock market’s return over the course of Trump’s first — and likely only — 4-year term will be dismal, no matter what Trump does. However, the policies of a president can have a big effect on the performance of the economy.

It’s obviously early days for the Trump Administration, but the initial signs are not positive. The main reason is that “regime uncertainty” is on the rise.

“Regime uncertainty” is the name given to the tendency of private investors to pull back from making long-term financial commitments due to uncertainty about what the government will do next. According to an essay by Robert Higgs, it was one of the factors that prolonged the Great Depression of the 1930s. Government intervention is generally bad for the economy, but it tends to be even worse when it happens in an ad hoc way.

As discussed in a Bloomberg article last month, the economically-depressing effect of government by ad-hoc command was also addressed by Friedrich Hayek in “The Road to Serfdom”. The problem, in a nutshell, is that if the government’s actions are predictable then people are able to plan, but if officials are regularly issuing commands it will become much harder for people to have the kind of security that is a precondition for economic development and growth.

The signs were not good when Trump started singling-out individual companies for special treatment even before he took the oath of office and got worse when Trump started talking about imposing a 20% tax on Mexican imports as a way of forcing Mexico to pay for a wall between the two countries. Does he really believe that forcing US consumers to pay 20% more for products made in Mexico amounts to making Mexico pay for the wall?

And the signs recently became more worrisome due to the sudden imposition of immigration and refugee bans. The effects of these bans on the US economy will not be significant, but the concern is what they imply about the decision-maker’s level of understanding and willingness to ‘shoot from the hip’.

The immigration ban imposed on seven Muslim-majority countries is a particular concern because of its blatant irrationality. Making America safe from terrorism is the official justification for the action, but over at least the past 40 years there has not been a single fatal terrorist attack perpetrated on US soil by anyone from any of the banned countries. On the other hand, Saudi Arabia is not covered by the ban despite having supplied 15 of the 19 terrorists directly involved in the 9/11 attacks and being well known as a state sponsor of terrorist organisations. I am not suggesting that the ban should be expanded to include other countries, I am questioning the knowledge and logicalness of a political leader who would decide to do what has just been done.

To top it all off, late last week Trump began threatening Iran for no good reason via his preferred medium for conducting international diplomacy: Twitter. What will he do next?

Taking a wider angle view, the protectionist agenda that the Trump Administration seems determined to implement will have numerous adverse consequences, most of which aren’t quantifiable at this time because it isn’t known exactly what measures will be taken and how other governments will react. All we know for sure is that Trump wrongly believes that international trade is a win-lose scenario and that trade deficits are problems for governments to actively reckon with.

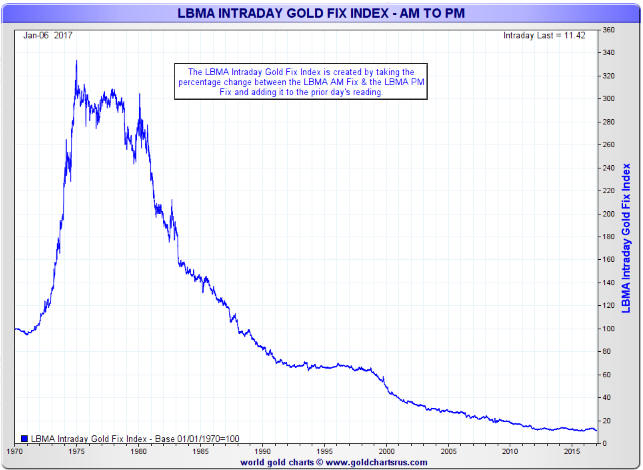

Perhaps the initial warning signs are not indicative of what’s to come and Team Trump will settle into a more logical, impartial and cool-headed approach, but right now it looks like Donald Trump is going to make uncertainty great again. If so, private investment will decline.