Some analysts state that the US stock market is over-valued and also that the stock market is good at discounting the future. Well, it can’t be both! If the stock market is good at discounting the future then current valuations are reasonable based on the profits that will be earned by companies over the next few years. On the other hand, if the stock market is over-valued then it is, by definition, doing a poor job of discounting the future.

Perhaps the stock market was once good at discounting the future, but a knowledgeable observer couldn’t claim with a straight face that the US stock market has been a good discounting mechanism over the past 20 years. Over this period we’ve seen valuations reach stratospheric levels in response to delusions about tech and internet company earnings, and then a collapse to bring prices into line with reality, followed by another rise to stratospheric valuations based on delusions that global growth knew no bounds and low-quality loans could be bundled together to create investment-grade securities, and then another collapse to bring prices into line with reality, followed by yet another upward ramp to stratospheric valuations.

The most recent multi-year ramp-up in stock prices was supposedly due to the discounting of an imminent ramp-up in corporate earnings, but S&P500 earnings during the second quarter of this year were no higher than they were three years earlier.

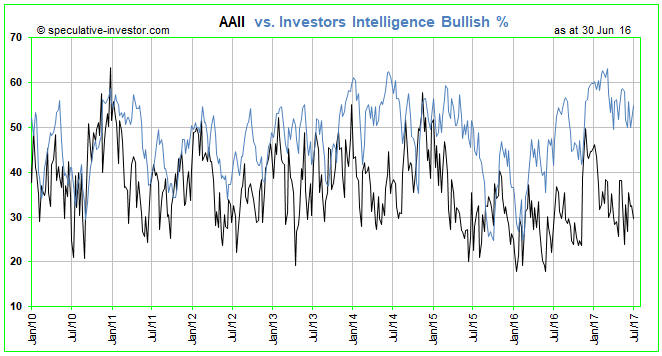

It is not difficult to come up with a superficial explanation for the US stock market’s abysmal 20-year record as a discounting mechanism. The explanation begins with the observation that from 1996 through to 2007 the market was dominated by the public, and, as the saying goes, the public will believe the most preposterous of bullish stories as long as the price is rising. As a result of the 2008 collapse, the public left the market and has not returned. At an earlier period in history this might have resulted in longer-term value-oriented investors taking control, but this time around it resulted in the market becoming dominated by computerised trading systems designed to scalp profits from extremely short-term fluctuations. That is, the market is now dominated by traders that make no attempt to discount the future beyond the next few hours or minutes.

The above explanation contains some truth, but for two main reasons it is far from complete. First, the general public hasn’t changed — it always has been and always will be the dumb money. Second, computerised trading systems are equally ‘happy’ to scalp profits by going short during declines or going long during advances. They are directionally neutral.

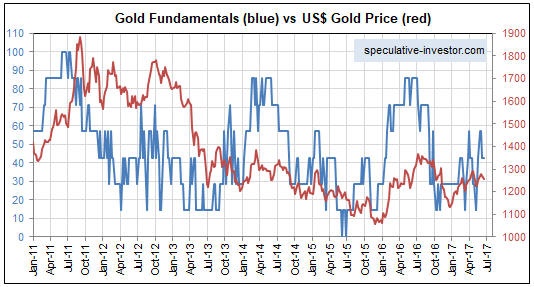

A better explanation begins with the realisation that the stock market as a whole has NEVER been a discounting mechanism. It has, instead, always reacted with a lag to changes in the monetary backdrop. The big difference over the most recent two decades is that for the most part the monetary backdrop has been far more supportive of asset prices than in the past. One consequence has been the stock market’s ability to spend a lot more time than usual in a condition called “extreme over-valuation”.