According to the article linked HERE, if the US or the Australian or the UK government repaid all of its debt, the economy would tank. The article contains such a large number of factual errors and such a copious amount of nonsense that completely debunking it would take far more time than I’m prepared to spend, so in this post I’ll only deal with a few of the flaws.

To begin, the article points out that US government surpluses have, in the past, often been followed by depressions or recessions, the implication being that the government surplus caused the subsequent economic downturn. The two specific examples that are mentioned are the Great Depression of the 1930s, which apparently followed surpluses during the 1920s, and the recession of 2001, which followed the so-called Clinton surplus of 1999.

This is nothing more than confusing correlation with causation. The same logical fallacy could be used to show that a rising stock market causes a depression or recession, given that the stock market almost always rises during the years prior to the start of an economic contraction.

In an effort to show that there is, indeed, a causal relationship between a government surplus and a severe economic downturn, the article includes the following quote from an ‘economist’:

“…reducing or retiring the debt isn’t what caused the economic downturns. It was the surpluses that caused it. Simply put, you cannot operate an economy with no money in it.”

This brings me to the concept that runs through the article and is the logical basis for the assertion that government surpluses are very bad. It is that the running of a government surplus removes money from the economy and, therefore, that paying off most of the government’s debt would eliminate most of the economy’s money. That the author of the article found economists who genuinely believe this to be the case is extraordinary. It is akin to finding a physicist who genuinely believes that the Earth is flat.

The fact is that neither a government surplus nor a government deficit alters the economy-wide supply of money; all it does is change the distribution of the existing money supply. Here’s why.

First, when the government runs a deficit it is a net taker (borrower) of money from bond investors. It then spends the money. Money is therefore cycled from bond investors through the government to the individual or corporate recipients of government payments (including government employees). If this money had not been ‘invested’ in government bonds then it would have been invested elsewhere and subsequently spent in a different way.

Second, when the government runs a surplus it is a net provider of money to bond investors, with money being cycled from taxpayers through the government to the accounts of these investors. Collectively, the bond investors who receive these payments immediately turn around and reinvest them in corporate bonds or equity. Private corporations then spend the money on employee wages, employee healthcare, supplies, maintenance, plant, training, dividends, etc.

Either way, there is no change to the economy-wide money supply.

To further explain, in general terms there are only two ways that money can be added to the economy. The first involves deposit creation by commercial banks. For example, when Fred borrows $1M from his bank to buy a house, the bank adds 1M newly-created dollars to Fred’s demand account. That is, the money supply is boosted by $1M. The second involves asset monetisation by the central bank. In the US case, prior to 2008 almost all money was created by commercial banks, but from September-2008 through to the end of “QE” in October-2014 the Fed was the dominant creator of new money. Since November of 2014 the commercial-banking system has been the sole net-creator of new money.

In general terms there are also only two ways that money can be removed from the economy. The first involves the elimination of a deposit at a commercial bank when a loan is repaid (note that a loan default does not reduce the money supply). For example, if Fred were to pay-off his $1M home mortgage in one fell swoop then $1M would immediately be removed from the money supply. The second involves the sale of assets by the central bank — the opposite of the asset monetisation process.

Notice that the government was not mentioned in the above two paragraphs. Regardless of whether the government is running a budget deficit or a budget surplus, the banking system determines whether the supply of money rises or falls. I’m not saying that’s the way it should be, but that’s the way it is.

The next part of the article is a tribute to the old canard that the government’s debt doesn’t matter “because we owe it to ourselves”. In reality, there is no “we” and “ourselves”. The government’s debt comprises bonds that are owned by a few specific entities. It is to those entities, that in the US case includes foreign governments, to whom the debt is owed, with taxpayers technically being ‘on the hook’ for the future repayment. I say “technically” because what happens in practice is that the debt is never repaid; it just grows and grows until eventually the entire system collapses.

Related to the “government debt doesn’t matter because we owe it to ourselves” nonsense is the notion that the government’s debt is the private sector’s asset and, therefore, that more government deficit-spending leads to greater private-sector wealth. Ah, if only wealth creation were that easy! In the real world, government debt is not an additional asset for the private sector, it is a replacement asset. This is because when the government issues new debt it necessarily draws money away from other investments. Putting it another way, investing money in government bonds involves foregoing other investment opportunities. To argue that this would be a plus for the economy is to argue that the government usually allocates savings more productively than the private sector.

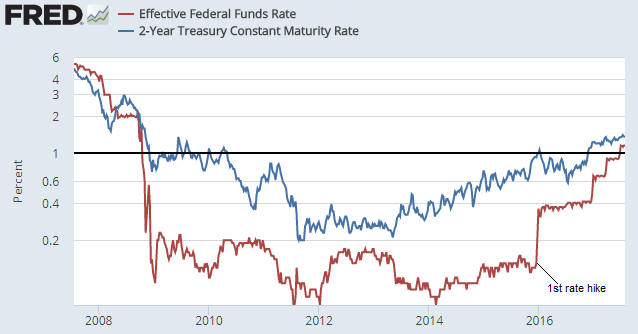

There are a lot more logical fallacies and factual errors in the article than I’ve dealt with above, but I’m going to leave it there. I just wanted to point out that much of what is observed about the relationship between government indebtedness and private-sector indebtedness can be explained by central bank manipulation of money and interest rates. When the central bank fosters an artificial boom via monetary inflation and the suppression of interest rates it prompts the private sector to go further into debt, which, by the way, is not an unintended effect.* At the same time, the rising asset prices and the temporary increase in economic activity that stem from the same monetary policy cause more money to flow into the government’s coffers, which could temporarily enable the government to report a surplus and should at least result in a slower pace of government debt accumulation. That is, it isn’t the reduced pace of government debt accumulation that causes the pace of private sector debt accumulation to accelerate; the driving force is the central bank’s misguided attempt to stimulate the economy.

I’ll end by stating that a government surplus is not inherently better or worse than a government deficit. What really matters is the total amount of government spending as a percentage of the overall economy. The higher this percentage, the worse it will be for the economy.

*Ben Bernanke made it very clear during 2009-2014 that the Fed’s actions were designed to boost the private sector’s borrowing and general risk-taking.

Print This Post

Print This Post