1. There is no longer any correlation between bank reserves and the economy-wide money supply, meaning that the “money multiplier” taught in economics classes no longer applies.

2. In the US the government-Fed combination can increase the money supply to almost any extent independently of the private banks. That is, monetary inflation does not rely on the expansion of credit via the private banking industry.

3. The Fed is not constrained in any way by the need/desire to maintain a strong balance sheet.

4. The bulk of the central bank’s money creation involves the monetising of EXISTING assets, meaning that the central bank can increase the money supply without increasing the economy-wide quantity of debt. Furthermore, the central bank is capable of monetising almost anything.

5. A motivated central bank will always be able to increase the money supply, and growth in the money supply always leads to higher prices SOMEWHERE in the economy. For speculators and investors, the challenge is to figure out where.

6. The bond and currency markets eventually could impose practical limits on government borrowing and monetary inflation, but the government will be free to borrow and the Fed will be free to inflate as long as the bond and currency markets remain cooperative.

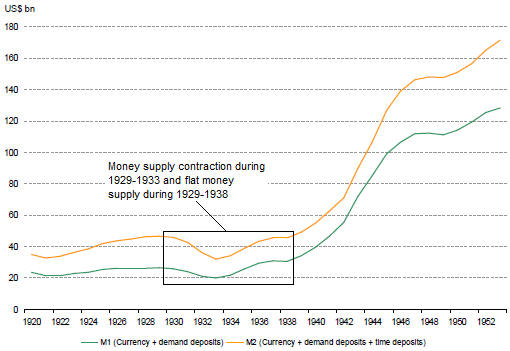

7. A corollary of points 5 and 6 is that the probability of the US experiencing deflation will remain low until after the T-Bond and/or the US$ tank. Putting it another way, the probability of the US experiencing deflation will remain low until after inflation is widely perceived to be a major problem.

8. There are long and variable time delays between changes in the money supply and the appearance of the price-related effects of these changes. This leads to an inverse relationship between the rate of monetary inflation and the fear of inflation, because the average person’s fears/expectations are based on the effects of previous money-supply changes as opposed to what’s currently happening on the monetary front.

9. An increase in the general price level is not the most important effect of monetary inflation. Of far greater importance: monetary inflation changes the STRUCTURE of the economy in an adverse way, by a) distorting relative prices, leading to malinvestment on a broad scale, and b) transferring undeserved benefits to the first receivers of the new money at the expense of everyone else.

10. Because monetary stimulus changes the structure of the economy, its bad effects cannot be cancelled-out by the subsequent withdrawal of the stimulus. Instead, the distortions/wastage caused by monetary stimulus will be revealed after the flow of new money is restricted. An attempt to sustain the stimulus indefinitely, and thus avoid the collapse that inevitably follows a period of inflation-fueled ‘growth’, will end in hyperinflation.

11. “Money velocity” is a redundant concept at best and a misleading one at worst. The same can be said about the famous Equation of Exchange (MV = PT), which is where money velocity (V) comes from. In the real world there is money supply and there is money demand; there is no such thing as money velocity.

12. Falling prices are never a problem — they are either the natural consequence of increasing productivity (real economic growth) or part of the solution to a problem (in the case of a bursting credit bubble).

13. A corollary of point 12 is that the central bank’s attempts to force prices to rise either counteract the benefits of increasing productivity or prevent the correction of the problems stemming from a credit bubble.

14. Credit expansion can foster sustainable economic growth only when it involves the lending of real savings by private individuals or corporations.

15. Economic growth is driven by savings and production, not consumer spending.

16. The government and the central bank have no real capital or wealth that can be used to help the economy in times of trouble. Therefore, monetary and fiscal “stimulus” programs involve stealing from one set of people and giving to another set of people. Obviously, the economy cannot be strengthened by large-scale theft.

Print This Post

Print This Post