[This blog post is an excerpt from a commentary published last week at www.speculative-investor.com]

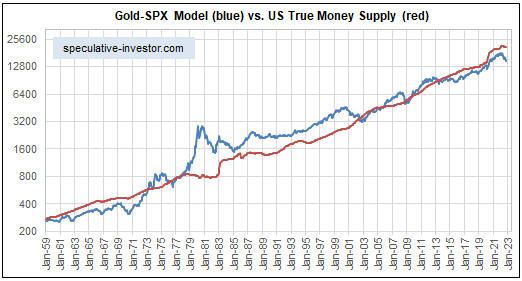

In a world where the official currencies make poor measuring sticks due to their relentless and variable depreciation, looking at the relative performances of different investments is the best way to determine which ones are in bull markets. Furthermore, because they are effectively at opposite ends of an investment seesaw, with one doing best when confidence in money, central banking and government is rising and the other doing best when confidence in money, central banking and government is falling, this is a concept that works especially well for gold bullion and the S&P500 Index (SPX).

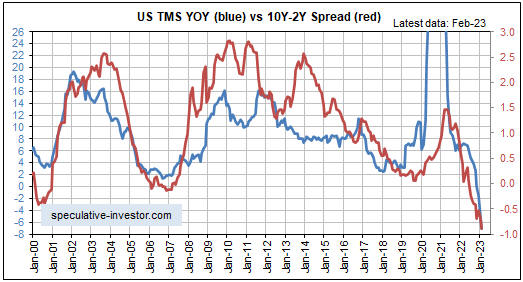

There will be times when both gold and the SPX are rising in US$ terms, but it should be possible to tell the one that is in a genuine bull market because it will be the one that is relatively strong. More specifically, if the SPX/gold ratio is in a multi-year upward trend then the SPX is in a bull market and gold is not, whereas if the SPX/gold ratio is in a multi-year downward trend then gold is in a bull market and the SPX is not. There naturally will be periods of a year or longer when it will be impossible to determine whether a multi-year trend has reversed or is consolidating (we are now in the midst of such a period), but there is a moving-average crossover that can be used to confirm a reversal in timely fashion.

For at least a decade, we have been monitoring the SPX/gold ratio (or the gold/SPX ratio) relative to its 200-week MA to ascertain whether gold or the SPX is in a long-term bull market*. The idea is that when the SPX/gold ratio is above its 200-week moving average, it means that the SPX is in a bull market and gold is not. And when the ratio is below this moving average, it means that gold is in a bull market and the SPX is not.

The following weekly chart shows that since 1980 the SPX/gold ratio relative to its 200-week MA (the blue line) has generated only two false signals. Both of these false signals occurred as a result of stock market crashes — the October-1987 crash and the March-2020 crash. The chart also shows that since peaking in late-2021, the SPX/gold ratio has dropped back to its 200-week MA but is yet to make a sustained break to the downside.

The next weekly chart zooms in on the SPX/gold ratio’s more recent performance. This chart makes it clear that over the past 12 months the ratio has been oscillating around its bull-bear demarcation level.

It’s likely that an SPX bear market, and therefore a gold bull market, began in late-2021, but there remains some doubt. The remaining doubt would be eliminated by the SPX/gold ratio breaking below its March-2023 low.

Further to comments we made in the latest Weekly Update, the only plausible alternative to the bear-market-rebound scenario for the US stock market is that a bear market has not yet started. This is clearer when looking at the SPX in gold terms than when looking at the SPX in nominal dollar terms. What we mean is that the moderate pullback in the SPX/gold ratio to its 200-week MA clearly was not a complete bear market; it was either the start of a bear market or it was a bull-market correction.

Our view is that a multi-year equity bear market is in progress. However, if the SPX/gold ratio fails to break below its March-2023 low within the next few months and instead makes its way upward, then what transpired during 2022 was an intermediate-term stock market correction within a bull market.

*A January-2019 blog post discussing the concept can be found HERE.

Print This Post

Print This Post