“There are many ways of calculating purchasing power by means of index numbers, and every single one of them is right, from certain tenable points of view; but every single one of them is also wrong, from just as many equally tenable points of view. Since each method of calculation will yield results that are different from those of every other method, and since each result, if it is made the basis of practical measures, will further certain interests and injure others, it is obvious that each group of persons will declare for those methods that will best serve its own interests. At the very moment when the manipulation of purchasing power is declared to be a legitimate concern of currency policy, the question of the level at which this purchasing power is to be fixed will attain the highest political significance.”

The above paragraph contains remarkable foresight considering that it was written by Ludwig von Mises way back in 1934 (it is from the preface to the 1934 English edition of “Theory of Money and Credit”). In particular:

1) There are now more ways than ever of coming up with a number that purportedly represents the change in money purchasing power (PP), with different groups advocating on behalf of different numbers depending on their agendas. For one example, the US government likes the Consumer Price Index (CPI), because its rate of increase has been very slow for a long time (enabling cost-of-living adjustments to be minimised) and because the calculation methodology can always be changed by the government if the result deviates too far from what’s deemed acceptable. For another example, the Fed likes the Personal Consumption Expenditures (PCE) calculation, because it tends to be even lower than the CPI and therefore shows the Fed in a more positive light and gives it more flexibility. For a third example, at the other end of the spectrum there are the perennial forecasters of hyperinflation who are always on the lookout for ‘evidence’ supporting their outlook. This group likes the Shadowstats CPI, even though the Shadowstats calculation contains a basic error that makes the result unrealistic and leads to ridiculous conclusions regarding GDP growth.

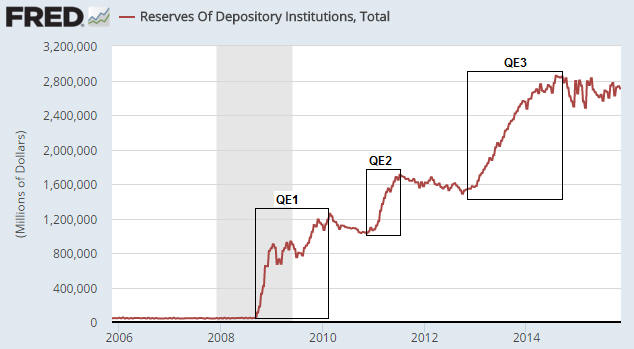

2) The manipulation of PP is most definitely now deemed to be a legitimate concern of currency policy. In fact, it is generally deemed to be the primary concern.

3) The question of the level at which PP is to be fixed has attained the highest political significance, with senior policy-makers throughout the developed world having almost simultaneously arrived at the conclusion that 2% is the correct level for the rate of annual PP loss. As a consequence, economies and financial markets are now being constantly pummeled by central-bank interventions designed to ensure that monetary savings lose about 2% of their PP every year.

It would be nice if prices returned to being indicators of genuine supply and demand, as opposed to being the effects of the central bank’s latest attempts to make an arbitrary index of prices match an arbitrary target.