With the US$ gold price near a 5-year low, the above question probably seems strange. However, the US$ isn’t the only measure of price.

It is also reasonable to measure gold’s price in terms of other commodities. This is because although gold isn’t just a commodity, under the current monetary system its price should never become divorced from the prices of other commodities. Short-term divergences between gold and the broad-based commodity indices will occur in response to macro-economic developments, but, for example, there isn’t going to be a major upward trend in the gold price while the prices of most other commodities are in major downward trends.

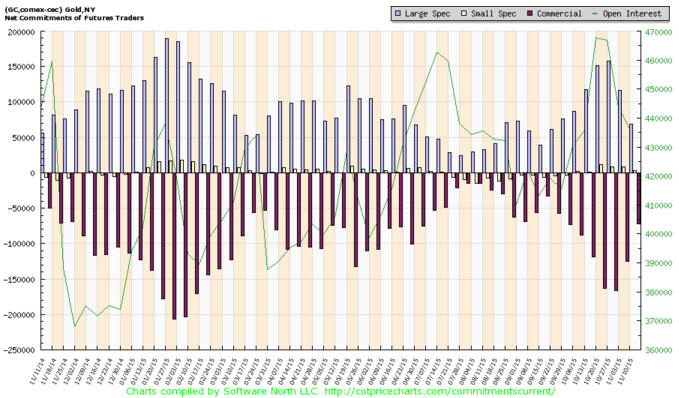

When measured in terms of other commodities, gold’s current price is high. For example, the following chart shows that gold made a new 20-year high relative to the Goldman Sachs Spot Commodity Index (GNX) in January and has recently moved back to near its high.

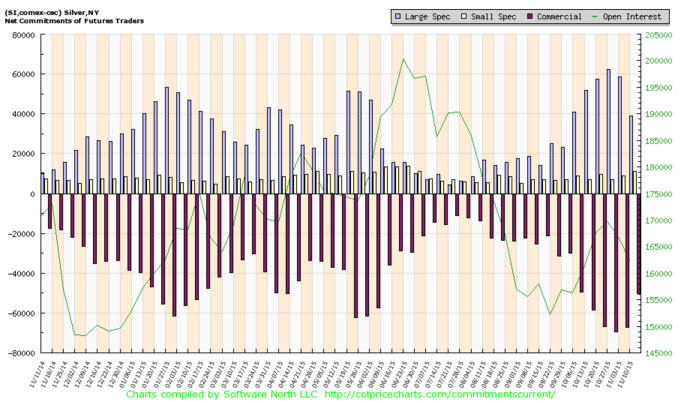

And if we measure gold in terms of other metals rather than commodities in general, it’s a similar story. In particular, the following charts show that a) relative to the Industrial Metals Index (GYX) gold is only 6% below its 2011-2012 highs and within 15% of the 20-year high that was reached at the crescendo of the 2008-2009 global financial crisis, b) gold is at a 20-year high relative to platinum, and c) gold is close to the top of its 20-year range relative to silver.

Gold normally performs relatively poorly during economic booms and relatively well during economic busts. Gold’s current relatively high price is therefore indicative of a weak global economic situation.

If the global economic backdrop becomes superficially better over the months/quarters ahead and the Fed hikes interest rates as per its current tentative plan, then even if the gold price rises in US$ terms next year it will probably fall in terms of the broad-based commodity indices and most other metals. That, of course, is a big if.

Print This Post

Print This Post