[This blog post is an excerpt from a TSI commentary published last week]

The US 10yr-2yr yield spread, a proxy for the US yield curve, has rebounded sharply over the past couple of weeks (refer to the following daily chart), from more than 100 basis points below zero to ‘only’ about 50 basis points below zero. Is this the start of a steepening trend for the US yield curve?

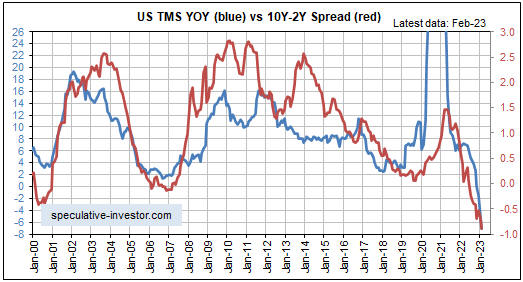

There is one good reason to believe that the recent upturn shown on the above chart did NOT mark the start of a new trend. The reason is the relationship between the monetary inflation rate (the blue line) and the 10yr-2yr yield spread (the red line) illustrated on the chart displayed below. This chart shows that the yield spread tends to follow the monetary inflation rate and that the monetary inflation rate was still in a downward trend at the end of February-2023.

Further to the above chart, a yield curve inversion is caused by a large decline in the monetary inflation rate and a major shift in the yield curve to a new steepening trend is caused by a major upward reversal in the monetary inflation rate. Currently there is no sign of an upward reversal in the monetary inflation rate.

As an aside, the 10yr-2yr spread is just one indicator of the yield curve. The 10yr-3mth spread (see chart below) is equally important and made a new inversion extreme on Monday of this week. In other words, there is no evidence of a shift towards steepening in the 10yr-3mth spread.

Perhaps it will be different this time and a yield curve shift to a steepening trend will precede a money-supply growth rate reversal, but we wouldn’t bet on it. As long as monetary conditions as indicated by the monetary inflation rate are still tightening, there will be upward pressure on short-term interest rates relative to long-term interest rates. This is because short-term interest rates will be kept relatively high by the increasingly urgent desire for short-term financing, while long-term zero-risk interest rates will reflect the expected eventual effects on prices and economic activity of today’s tight monetary conditions.