The following charts from www.sharelynx.com are referenced in an email that will soon be sent to TSI subscribers.

Print This Post

Print This Post

The following charts from www.sharelynx.com are referenced in an email that will soon be sent to TSI subscribers.

Print This Post

Print This Post

This post is a slightly-modified excerpt from a recent TSI commentary.

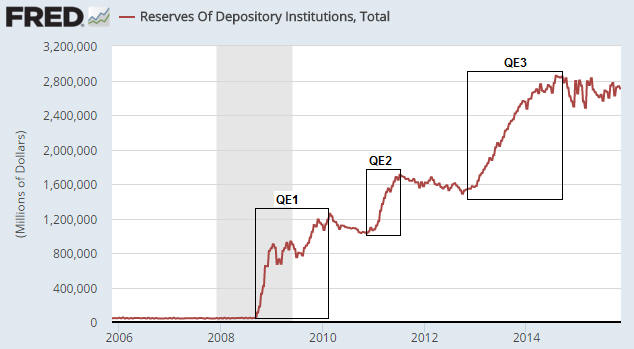

In the US, the commercial banks can create money and the Fed can create money. A chart showing the change in the US money supply therefore won’t directly tell us if the Fed was a creator of new money during the period covered by the chart. However, unlike the commercial banks, when the Fed monetises debt it boosts bank reserves as well as the money supply, which means that we can quickly identify the periods during which the Fed was a direct creator of new money by looking at a chart of the total quantity of US bank reserves. Such a chart is displayed below.

With reference to this chart, notice the huge rises in bank reserves during the periods labeled “QE1″, “QE2″ and “QE3″. These are the times when the Fed was directly creating new money. The downward/sideways drifts in bank reserves prior to the start of “QE1″, between the QE programs and since the end of “QE3″ are times when the Fed was not directly creating new money. The US money supply still increased during these ‘non-QE’ periods, but it increased due to the actions of commercial banks rather than the direct intervention of the Fed.

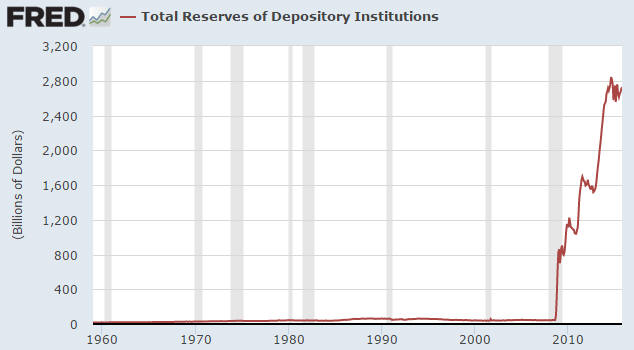

To put the 2008-2015 period into perspective, here is a chart showing the total quantity of US bank reserves going back to 1959. Notice that for decades prior to 2008, total bank reserves hovered just above zero. There was a lot of monetary inflation during this period, but almost none of it was due to the direct creation of money by the Fed.

As an aside, if you compare the above chart of bank reserves with a chart of commercial bank credit you will see that over the past few decades there has been no relationship between bank reserves and the quantity of money loaned into existence by US commercial banks. That’s why, as I wrote in a recent blog post (https://tsi-blog.com/2015/10/the-zero-reserve-banking-system/), it’s more realistic to think of the US as now having a zero-reserve banking system as opposed to a fractional-reserve banking system. Bank reserves are a throw-back to an earlier monetary system, when gold was held in reserve and receipts for gold circulated within the economy. It makes no sense to have dollars backed by dollars, especially since the quantity of dollars held in reserve in no way determines/limits the quantity of dollars loaned into existence or held in bank deposits.

An extraordinary situation can start to seem ordinary if it persists for long enough, so the main point I wanted to reiterate with the help of the above charts is that the past several years constitute a massive and unprecedented departure from the Fed’s traditional mode of operation. An implication is that the Fed’s next monetary tightening program, which may or may not tentatively begin with a tiny rate hike in December, will not look like any previous monetary tightening program. The “uncharted waters” cliche is now very appropriate.

Print This Post

Print This Post

If you listen to the top central bankers of the world talk for long enough you will come away with the impression that central banks are attempting to give us “price inflation”, as if rising prices were beneficial. However, nobody wants to pay more for stuff. In fact, rational people prefer to pay less, not more. Therefore, when central banks claim to be giving us “price inflation” what they are really doing is stealing the “price deflation” from which we would otherwise benefit.

We are told that a general expectation of rising prices is important, because if people start expecting prices to be lower in the future then they will curtail their spending in the present. This, apparently, will lead to an economically-disastrous downward spiral in which the general expectation of lower prices leads to reduced spending and reduced spending leads to even lower prices.

The economic ‘logic’ contained in the idea that expectations of higher prices are needed to promote present-day spending explains why companies like Apple can never sell anything. After all, who in their right mind would buy an Apple product today when they can be sure that a better product will be available at a lower price by this time next year?

And just imagine how bad it would be if prices trended lower throughout the entire economy the way they do in the computing and mobile communications industries. There would be almost no spending anywhere! That operation to save your life that you have scheduled for next week could be postponed until healthcare charges have declined to much lower levels. And all of the eating you were planning on doing over the next few months could be delayed indefinitely in anticipation of more attractive food prices. And there would never be a good reason to buy a house or a car because each year you did without these things, the more of a bargain they would become and the better off you would be for not having bought earlier.

Also, try to imagine how bad it must have been before there were central banks to guarantee a continuous rise in the general price level. If expectations of rising prices are needed to promote spending and growth, then in pre-central-bank days, when money often increased in purchasing-power from one year to the next, there must have been almost no spending anywhere in the economy. That is, there must have been relentless economic contraction. Thankfully, we now have people like Ben Bernanke, Janet Yellen, Mario Draghi and Haruhiko Kuroda to save us from such a predicament.

The point that hopefully hasn’t been totally obscured by my sarcasm is that central bankers are thieves. They are stealing our deflation. It isn’t fair to compare them with common burglars, though, because common burglars don’t claim to be doing you a favour while they make off with your valuables.

Print This Post

Print This Post

With the US$ gold price near a 5-year low, the above question probably seems strange. However, the US$ isn’t the only measure of price.

It is also reasonable to measure gold’s price in terms of other commodities. This is because although gold isn’t just a commodity, under the current monetary system its price should never become divorced from the prices of other commodities. Short-term divergences between gold and the broad-based commodity indices will occur in response to macro-economic developments, but, for example, there isn’t going to be a major upward trend in the gold price while the prices of most other commodities are in major downward trends.

When measured in terms of other commodities, gold’s current price is high. For example, the following chart shows that gold made a new 20-year high relative to the Goldman Sachs Spot Commodity Index (GNX) in January and has recently moved back to near its high.

And if we measure gold in terms of other metals rather than commodities in general, it’s a similar story. In particular, the following charts show that a) relative to the Industrial Metals Index (GYX) gold is only 6% below its 2011-2012 highs and within 15% of the 20-year high that was reached at the crescendo of the 2008-2009 global financial crisis, b) gold is at a 20-year high relative to platinum, and c) gold is close to the top of its 20-year range relative to silver.

Gold normally performs relatively poorly during economic booms and relatively well during economic busts. Gold’s current relatively high price is therefore indicative of a weak global economic situation.

If the global economic backdrop becomes superficially better over the months/quarters ahead and the Fed hikes interest rates as per its current tentative plan, then even if the gold price rises in US$ terms next year it will probably fall in terms of the broad-based commodity indices and most other metals. That, of course, is a big if.

Print This Post

Print This Post

There was a post at ZeroHedge.com on 20th November titled “Fed To Hold An “Expedited, Closed” Meeting On Monday“. The title suggests that something strange is afoot, that is, that the Fed is up to something out of the ordinary. Hence the emphasis on the words “Expedited” and “Closed”.

To make sure that its readers get the message, the post goes on to state:

“Given how awesome everything appears to be, judging by stocks and the tidal wave of FedSpeak of the last week confirming that rates are rising in December, we found it at least marginally ‘odd’ that out of the blue, the Fed would announce an ‘expedited, closed’ meeting on Monday…”

Odd? Out of the blue? Really?

The author of the ZeroHedge post forgot to mention that these “expedited, closed” meetings happen with monotonous regularity. The one scheduled for Monday 23rd November will be the third one this month. And there were four in October, three in September, two in August and five in July. You can find the notice for the coming meeting and the records of previous similar meetings at http://www.federalreserve.gov/aboutthefed/boardmeetings/201511.htm.

Even the topic under discussion at the 23rd November meeting will be routine. The purpose of the meeting is: “Review and determination by the Board of Governors of the advance and discount rates to be charged by the Federal Reserve Banks.” A meeting with the same purpose happens every month. For example, there was one on 26th October, one on 15th September, one on 31st August and one on 27th July.

Always be aware of the agenda/bias of the news sources you use.

Print This Post

Print This Post

In a typical commodity market the traders known as “commercials” are usually hedging their exposure to the physical commodity when they buy or sell futures contracts. For example, in the oil market the most important “commercials” include oil producers, who are naturally ‘long’ the physical commodity and often sell futures contracts to hedge this exposure, and manufacturers of oil-based products, who are effectively ‘short’ the physical commodity (by virtue of the fact that oil is one of their biggest costs) and often buy futures contracts to hedge this exposure. However, the gold market is different.

Some of the commercial traders operating in the gold market are traditional hedgers. Mining companies and jewellery manufacturers, for example. But given that the existing aboveground stock of gold dwarfs the annual supply of new gold and that the amount of gold that changes hands for store-of-value, investment and speculative purposes dwarfs the amount of gold bought/sold for more traditional commercial uses such as fashion jewellery and electronics, a reasonable and knowledgeable person would expect that traditional commercial traders would play a relatively small role in the gold market. A reasonable and knowledgeable person would be right.

In the gold market the dominant commercials are not traditional hedgers. They are also not speculators, in that they rarely take positions that rely on the gold price moving in a particular direction. They are spread traders, meaning that they make their profits by trading the differences in price between the physical and futures markets.

For example, if speculative buying of gold futures causes the futures price to rise relative to the spot price by a sufficient amount it will create an essentially risk-free arbitrage opportunity for a commercial to sell the futures and buy the physical, and if speculative selling of gold futures causes the futures price to fall relative to the spot price by a sufficient amount it will create an essentially risk-free arbitrage opportunity for a commercial to buy the futures and sell the physical. For another example, if gold buying by hoarders of physical gold causes the cash (physical) price to rise relative to the futures price by a sufficient amount it will create an essentially risk-free arbitrage opportunity for a commercial to sell the physical and buy the futures, and if the ‘dishoarding’ of physical gold causes the cash (physical) price to fall relative to the futures price by a sufficient amount it will create an essentially risk-free arbitrage opportunity for a commercial to buy the physical and sell the futures. In other words, commercial trading in the gold market is mostly about arbitrage.

The difference between commercial trading in the gold market and commercial trading in all other commodity markets is tied to gold’s long history as money. Strangely, many gold ‘experts’ assert that gold is different due to its dominant monetary and store-of-value roles, but then insist on applying a traditional commodity-style method of supply-demand analysis. Unsurprisingly, the result is a pile of hogwash.

Print This Post

Print This Post

The following charts relate to comments on the gold and silver markets that will be emailed to TSI subscribers later today.

Print This Post

Print This Post

Way back in early-2009 and again in mid-2012 I wrote in TSI commentaries that if the story unfolded as I expected then a lot of future economic commentary would begin with the word “despite”, and that in most cases the commentary would be a lot closer to the truth if “despite” were replaced with “because of”. For example, a comment along the lines of “despite the huge monetary stimulus the economy remains weak” would be closer to the truth if it read “because of the huge monetary stimulus the economy remains weak.”

My 2009 assessment remains applicable in that most commentators still don’t get it and still use “despite” when they should be using “because of”. They still don’t realise that pumping money into the economy falsifies prices (including the price of credit, the most important price of all) in ways that make the economy less, not more, efficient. The reality is that the more the central bank tries to stimulate the economy via ‘loose’ money, the more it will HINDER economic progress.

A sensible way to use the word “despite” is in reference to plans for future stimulus. For example, it could reasonably be said that DESPITE the lack of logical support for creating money out of nothing and the evidence that previous QE programs did not help, it’s a near certainty that the Fed will introduce a new monetisation program if the economy gets much weaker. It could also be said that the US economy’s only hope is that the remnants of capitalism are strong enough to generate sustained improvement DESPITE the price distortions caused by the Fed.

Print This Post

Print This Post

This post is a slightly-modified excerpt from a recent TSI commentary.

The Federal Reserve has monetised a few trillion dollars of bonds over the past seven years without creating much in the way of what most people call “inflation” (a rise in the general price level). How could this happen?

One popular explanation is that the Fed’s Quantitative Easing (QE) adds to bank reserves, but not the economy-wide money supply. According to this line of thinking, the ‘money’ created by the Fed to purchase bonds remains trapped in reserve accounts at the Fed. However, this explanation can be immediately eliminated, because as previously explained every dollar of QE adds one dollar to bank reserves at the Fed AND one dollar to demand deposits within the economy. The fact is that the economy-wide money supply is now a few trillion dollars larger thanks to the Fed’s QE.

A second explanation is that QE isn’t “inflationary” because it involves the exchange of one cash-like instrument for another. This explanation can also be immediately eliminated due to the fact that it mistakenly conflates two very different things — money and debt securities. If you don’t understand the difference, try buying something with a T-Bill. You should then understand. Also, more information on this particular issue can be found in my 9th May post at the TSI Blog.

As an aside, QE is not only NOT an exchange of one cash-like instrument for another, it involves increasing the amount of cash in the financial system and simultaneously decreasing the amount of financial assets that can be bought with cash. That is, it results in more cash ‘chasing’ fewer assets.

A third explanation is that the increase in the money supply stemming from the Fed’s QE has been offset, in terms of effect on the general price level, by a decrease in the velocity of money. This is yet another explanation that can be eliminated, because changes in “money velocity” never explain anything. The reason is that money velocity (V) is nothing more than a fudge factor that makes one side of the tautological and practically-useless equation of exchange (MV = PQ) equal to the other side. It exists in academia, but not in the real world. For more information on the irrelevance of money velocity, refer to my 10th June post at the TSI Blog.

Having eliminated three of the fatally-flawed explanations for why the Fed’s gargantuan QE hasn’t yet led to problematical “price inflation”, I’ll now provide two explanations that make some sense.

First, for decades prior to 2008 almost all of the US economy’s new money was created by commercial banks (commercial banks can loan new money into existence and they can also monetise securities). As a result, the first receivers of the new money tended to be within the ‘general public’ (home buyers/sellers, private businesses, etc.). However, since August-2008 almost two-thirds of all new money has been directly created by the Fed. This means that the first receivers of most of the new money were bond speculators, and that the second, third, fourth and fifth receivers of the new money were probably bond speculators or stock speculators. In other words, rather than being trapped in reserve accounts at the Fed as some people have mistakenly asserted, it is likely that a lot of the new money has effectively been trapped within the financial markets. It will eventually leak out into the ‘real’ economy, but due to the way the money was created/injected there has been a much longer-than-usual delay between the money creation and the inevitable effects on everyday prices.

Second, it’s important to understand that even if it were possible to come up with a single number that reliably reflected the actual change in the economy-wide purchasing-power (PP) of money, this number would not tell us the “inflationary” effect of a change in the money supply. The reason is that to know the effect on money PP of a change in the money supply you have to know what would have happened to PP in the absence of the money-supply change.

For example, let’s assume for the sake of argument that there is a consumer price index (CPI) that reliably indicates the change in the general price level. In our hypothetical example, the CPI would have fallen by 10% over a certain period, but due to money-pumping by the central bank the CPI increases by 2%. In this case the “inflationary” effect of the central bank’s money-pumping is not a 2% increase in the CPI, it is a 12% increase in the CPI (the difference between what happened and what would have happened).

Taking into account the high private-sector debt levels that existed in 2008 and have persisted to this day, it is not hard to imagine that in the absence of the Fed’s money creation there would have been a sizable decline in the CPI rather than a moderate increase. The “inflation” caused by the Fed’s QE is the difference between the decline in the general price level that would have happened and the rise in the general price level that did happen.

In conclusion, there are two main contributors to the lacklustre performance of the “general price level” over the past few years. First, unlike in earlier cycles a lot of the money created during the current cycle was injected directly into the financial markets. Second, it’s likely that there would have been significant “price deflation” in the absence of the money-pumping.

Print This Post

Print This Post

One of the interesting aspects of the financial newsletter business is that an incorrect prediction of a market crash will probably drum-up a lot more new business than a correct prediction that there won’t be a crash. Hence, the never-ending popularity of crash-forecasting, despite the fact that such forecasts almost never pan out.

From the perspective of a newsletter writer or any other commentator on the financial markets, the best thing about forecasting a crash is the massively asymmetric reward-risk associated with it. If the market doesn’t crash this year, when it was supposed to according to your original forecast, then you can just say that the event has been delayed and will happen next year instead. You don’t have much to lose because people will soon forget the failed prediction and focus on the next prediction. And if it doesn’t happen next year, then just repeat the process because eventually the market will crash and your amazing prescience will be there for all to see. Furthermore, after you correctly predict a crash there will be thousands of people eager to find out your next big prediction and buy your newsletter/book. In other words, from the forecaster’s perspective the downside of making an incorrect crash forecast is trivial compared to the upside of making a correct crash forecast.

The point is that regardless of how many times you forecast a crash that never happens, you will only have to get lucky once and you will be set for life. From then on you can promote yourself, and be introduced in interviews, as the person who predicted the great crash of XXXX (insert year). From then on a large herd of ‘investors’ will hang on your every word and rush to buy your advice whenever your next big forecast hits the wires.

Having seen how the process works, I’m officially entering the crash forecasting business. My inaugural forecast is for the US stock market to crash during September-October of 2016.

My forecast isn’t a completely random guess, for four reasons. First, stock-market crashes have a habit of occurring in September-October. Second, the two most likely times for the stock market to crash are during the two months following a bull market peak and in the year after a bull market peak (that is, roughly a year into a new bear market). The 1929 and 1987 crashes are examples of the former, while the 1974 and 2008 crashes are examples of the latter. The current situation is that either 1) a bear market began a few months ago, in which case the opportunity to crash during the two months following the bull market peak was missed and the next opportunity will arrive during the second half of 2016, or 2) the bull market is intact, in which case a major peak is likely during the second half of next year. Third, market valuation is high enough to support an unusually-large price decline. Fourth, interest rates are likely to have an upward bias over the next 12 months.

A few months from now a lot of commentators on the financial markets will be forecasting a crash for September-October 2016. If/when the crash happens, remember that you read about it here first and be ready to pay a much higher price (higher than zero, that is) for my next big prediction.

Print This Post

Print This Post

Just once I’d like to read a negative critique of “Austrian” economics from someone who actually understands it, but up until now every piece of criticism I’ve come across has contained basic misunderstandings of what this school of economics is about. The latest example is a 6th November blog post by Martin Armstrong.

According to the beliefs expressed by Mr. Armstrong in the above-linked blog post, Austrian Economics informs us that “fiat” money causes the business cycle and that the business cycle began with the Industrial Revolution. Both of these beliefs are completely wrong. Austrian Economics does not say that the business cycle is caused by fiat money and it does not say that the business cycle began with the Industrial Revolution.

Austrian Economics informs us that the business cycle is caused by large increases in the supply of money that create the impression that there are more real savings in the economy than is actually the case. Over the past few centuries the dominant cause of these large money-supply increases in the most developed economies was “fractional reserve banking”, a practice that effectively began with goldsmiths issuing more receipts for gold than they had actual gold in their vaults. However, “Austrian Business Cycle Theory” does not revolve around the specific method via which the monetary inflation occurs. A king debasing the coinage or issuing large quantities of paper money could potentially have a similar effect to goldsmiths issuing unbacked receipts for gold or an economy being flooded with gold — in the days when gold was money — due to successful foreign conquest (e.g. Spain and the Conquistadors in the 1500s) or commercial banks lending new money into existence or modern central banks implementing QE.

As to the other of Mr. Armstrong’s aforementioned beliefs, anyone who has gone to the trouble of researching Austrian Economics would know that “Austrian” economists have analysed the monetary and economic developments that occurred throughout history. As a good economic theory should, Austrian Economics works in all circumstances. It works regardless of whether we are dealing with a large modern city, a small village, a man alone on an island, a free economy, a command economy, an economy that uses paper money, an economy that uses tangible money, a robust economy, an economy immersed in depression, and so on.

Towards the end of his post Mr. Armstrong makes two assertions that aren’t specifically related to Austrian Economics, but warrant clarification.

First, he writes:

“…tangible money must have a “use” other than money. Gold and silver were prized objects but had no utilitarian “use” value outside of jewelry. Gold was desirable but was not a vital commodity that served a purpose beyond its prized status like art. Therefore, numerous monetary systems have existed that were not gold based since the medium of exchange had to have a “use” value other than as money.”

The fact is that many things have been used as money throughout the ages, but the more advanced economies ended up gravitating towards gold and/or silver. One reason is that for an item to become money in a large and mostly-free economy it must have a use other than money, but the non-monetary demand for the item will ideally be very small — to the point of being trivial — relative to the monetary demand. Otherwise, changes in non-monetary demand could cause large and unpredictable swings in the purchasing-power of money. That’s why if markets were free to choose they would almost certainly not choose platinum as money, even though platinum has similar physical attributes to gold.

Second, he writes:

“Money is not a store of value; it is a medium of exchange. In that case, it is merely an agreed upon medium to supplant barter.”

This is mostly correct. However, if an item isn’t widely perceived to be a good store of value then in a free market it won’t generally be accepted as a medium of exchange and therefore won’t be money.

Print This Post

Print This Post

There are two general reasons for a trader with an intermediate-term or a long-term time horizon to sell a stock during a period of strength. The first encompasses the situations where the stock has reached the trader’s price target, or has become stretched to the upside in valuation terms, or has reached a price level at which the intermediate-term risk/reward is no longer favourable. When a stock is in such a position it offers what I call an “objective selling opportunity”. The second general reason is that even though a stock is not yet fully valued and is still well below the trader’s intermediate-term target, selling makes sense based on personal money-management considerations. I call this a “subjective selling opportunity”.

Many of the stocks I own and also many of the stocks I cover in the TSI newsletter are in the gold-mining sector. For these stocks, objective selling opportunities have been as scarce as hen’s teeth over the past 2.5 years. However, over this period there have, from my perspective, been many subjective selling opportunities. Most recently, the September-October rally created several such selling opportunities.

I can’t identify subjective selling opportunities for my readers as these opportunities are, by definition, determined by each individual’s financial position. However, what I can do is note when TSI stocks are becoming ‘overbought’ or nearing resistance that could limit the short-term upside. I can also (and do also) note when I’m taking some of my own money off the table.

Print This Post

Print This Post