The assertion that the gold price has been successfully manipulated downward over a great many years via the relentless selling of “paper gold” contains more than a few logical and factual holes. In this brief post I’m going to highlight one of these holes.

Before I get to the main point, it’s worth pointing out that in order to sell “paper gold” there must be demand for “paper gold”, since demand for physical gold cannot be satisfied with paper claims. It is also worth pointing out that downward pressure on the price of “paper” gold that was not supported by the “physical” market would inevitably result in the price of “paper” gold making a sustained and substantial move below the price of the physical commodity, which hasn’t happened. Over the past several years the prices of gold futures contracts have generally been very close to the spot price and there have been regular small dips in futures prices to below the spot price, but this situation is a natural and predictable effect of the Fed’s unnatural zero-interest-rate policy. Taking the US$ interest-rate backdrop into account, the price of “paper” gold has generally not been lower relative to the price of physical gold than a knowledgeable observer would expect.

The main point of this post is that while gold is different from other commodities, under the current monetary system the price of gold should never become completely divorced from the prices of other commodities. In particular, the price of gold should always remain within certain bounds relative to the price of platinum.

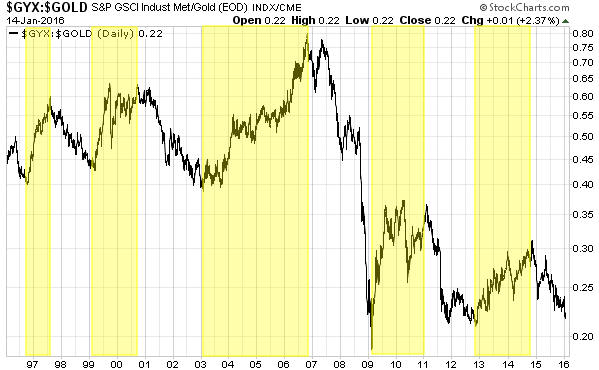

Now, the platinum market effectively ‘lives from hand to mouth’, in that the bulk of the current year’s consumption will be satisfied by the current year’s production. It should therefore be obvious to anyone with a modicum of objectivity that it isn’t possible to manipulate the platinum price downward, beyond brief fluctuations, by selling paper claims to the commodity. As a result, the multi-decade high in the gold/platinum ratio illustrated by the following chart is evidence that if there has been a concerted attempt to suppress the gold price, it has been ineffective to put it mildly.

I’ve come to understand that adopting the view that the gold market has been subject to a successful and long-term price suppression scheme is like adopting a child — it’s a lifetime commitment through thick and thin. I therefore don’t expect to change anyone’s opinion on this topic, but I’m hoping that some readers still have open minds.

Print This Post

Print This Post