I published a blog post in late-June titled “Gold has peaked for the year“. In this post I argued that relative to other commodities (as represented by the Goldman Sachs Spot Commodity Index – GNX) gold’s peak for 2016 most likely happened in February. As evidenced by the following chart, I was correct.

The reason for this follow-up post is not to give myself a public ‘pat on the back’. I’ve made my share of mistakes in the past and I will make mistakes in the future. The sole reason for this post is the vitriolic response that my earlier article received.

My earlier article should not have been controversial. After all, the February-2016 peak for the gold/GNX ratio wasn’t just any old high, it was an all-time high. In other words, at that time gold was more expensive than it had ever been relative to commodities in general. Furthermore, it is typical for gold to turn upward ahead of the commodity indices and to subsequently relinquish its leadership.

With gold having outperformed to the point where it was at its highest price ever relative to the prices of other commodities and with other commodities likely to recover, saying that gold had probably peaked for the year in commodity terms should have been viewed as a statement of the bleeding obvious. It would have taken a financial crisis of at least 2008 proportions during the second half of 2016, that is, it would have taken an extremely low-probability financial-market outcome, to propel the gold/GNX ratio to new highs during the second half of the year. That some readers took my “Gold has peaked” article as an affront was therefore remarkable.

Remarkable, but not really surprising given that in the minds of some gold devotees the gold price is always too low. It doesn’t matter how high the price is or what’s happening in the world, the price is always about to skyrocket. The only obstacle in the way is a cabal of evil market manipulators that will soon be overwhelmed by the forces of good. And in any case, a financial crisis of at least 2008 proportions is always about to happen.

Gold’s poor performance during the second half of 2016 was consistent with what I refer to as the true fundamentals*. This means that it wasn’t the result of downward manipulation. That being said, the great thing about believing that market trends have almost nothing to do with “fundamentals” and almost everything to do with manipulation is that you never have to be wrong. If any market goes against you it was due to the distortive effects of manipulation rather than a fatal flaw in your analysis.

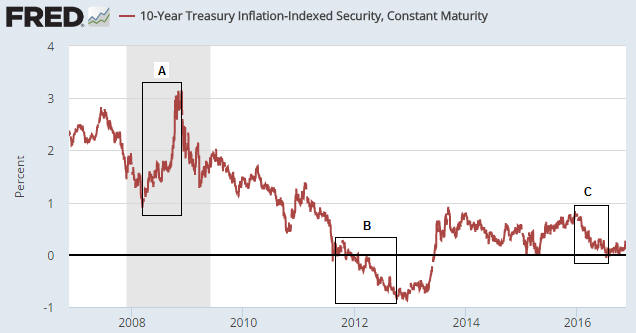

*The true fundamental drivers of the US$ gold price are, in no particular order: US credit spreads, the US yield curve, the real US interest rate, the relative strength of the US banking sector, the US dollar’s exchange rate and the general trend in commodity prices.

Print This Post

Print This Post