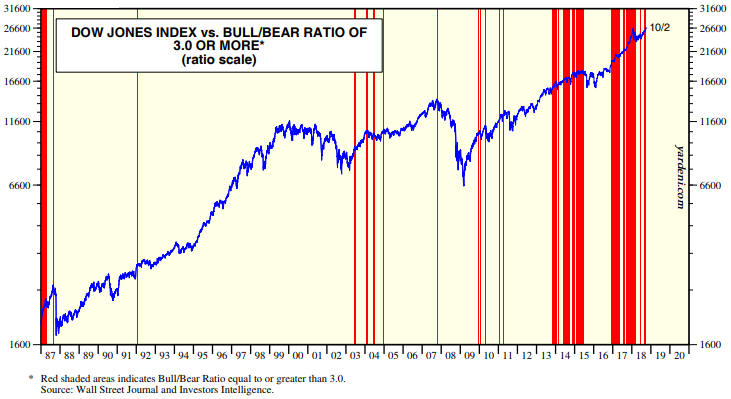

This post was prompted by a recent article authored by the always thought-provoking Pater Tenebrarum (a pseudonym) at acting-man.com. The article looks at the relationship between credit spreads and the stock market, in particular the historical tendency for credit spreads to begin widening prior to substantial stock market declines and thus to act as timely warning signals of impending stock market trouble. The conclusion is: “…it seems…more likely that a stock market decline will put pressure on junk bonds, instead of weakness in junk bonds providing advance warning of an impending stock market decline. The stock market sell-off in the past week did in fact very slightly lead a surge in high yield spreads.” I don’t know that this conclusion is wrong, but at this time the evidence to support it is not persuasive.

It first should be understood that credit spreads generally begin widening ahead of bear markets, but they generally DON’T lead short-term stock-market corrections. Therefore, the fact that they didn’t warn of the October-2018 sell-off is not meaningful at this time. It will become meaningful only if the October-2018 sell-off proves to be the first decline in a bear market, which is unlikely.

The fact that the most recent stock market sell-off appeared to slightly lead an up-tick (not a surge) in high yield spreads is also not meaningful. The following chart shows that junk bonds often trend with equities (the chart compares the iShares High Yield Corporate Bond ETF with the S&P500 ETF), so actually it is normal for short-term stock market corrections to go hand-in-hand with minor expansions of credit spreads. That’s what happened over the past 2 weeks, what happened in January-February of this year and what happened on numerous other occasions in the past.

The above-linked article makes the interesting point that credit spreads in the euro-zone and the US have diverged over the past year, with the former embarking on a widening trend in late-October of last year while the latter continued to contract. If credit spreads were still useful leading indicators of major stock-market trends then this divergence should have been accompanied by dramatic relative weakness in European equities. Since it was accompanied by dramatic relative weakness in European equities this is hardly evidence that credit spreads have lost their usefulness.

Could the influence of QE prevent credit spreads from signaling a trend reversal ahead of the next equity bear market?

I don’t see how. QE led to yield-chasing behaviour, which, in turn, caused credit spreads to become a lot narrower than they would have been. Having been compressed to artificially small quantities, credit spreads should if anything be more sensitive than usual to changes in the financial and economic backdrops.

Summing up, credit spreads have a strong tendency to widen ahead of equity bear markets. It could be different this time, but right now I can’t think of a good reason why it should be different. In any case, there is no need to rely on just one leading indicator.

Print This Post

Print This Post