[This blog post is a slightly modified excerpt from recent TSI commentary]

The root of Europe’s energy crisis is under-investment or outright dis-investment in nuclear energy and natural gas production/storage/transportation combined with over-reliance on intermittent and relatively inefficient forms of renewable energy. Russia’s invasion of Ukraine and the anti-Russia sanctions exacerbated the problem, but the problem was evident prior to this year. A policy course correction therefore would be appropriate (to put it mildly), but it won’t happen anytime soon.

When private companies go in the wrong direction they lose money and either change direction or go broke, but after it becomes clear that a government has gone in the wrong direction the typical response is to go faster in that direction. This is because doing otherwise would require an uncomfortable public admission that mistakes have been made or a practically impossible public admission that the political ideology underpinning the chosen direction is wrong. In the case of the shift towards increasing reliance on renewable energy, the latter (a public admission that the underlying political ideology is wrong) would be required, which is why we shouldn’t expect it. Instead, we should expect acceleration along the wrong path.

Signs of acceleration along the wrong path are not hard to find. Examples include the recent increase from 32% to 45% in the official European target for the renewable energy share of total energy, requiring a doubling of the renewable energy share within the next eight years, and the government of Victoria, Australia, recently announcing a goal to become 95% dependent on renewables by 2035.

It is not possible to achieve the renewable energy targets being set by governments, but nevertheless it’s reasonable to expect that great efforts will be made to achieve them. Here are some of the likely effects of these efforts:

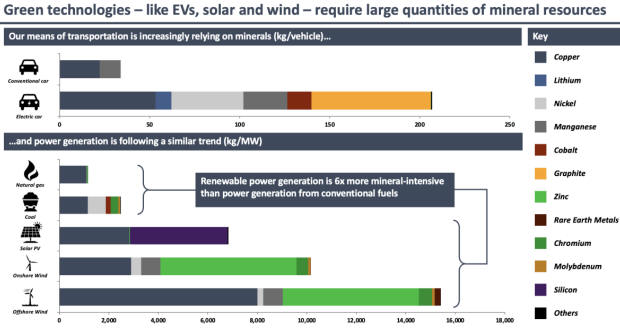

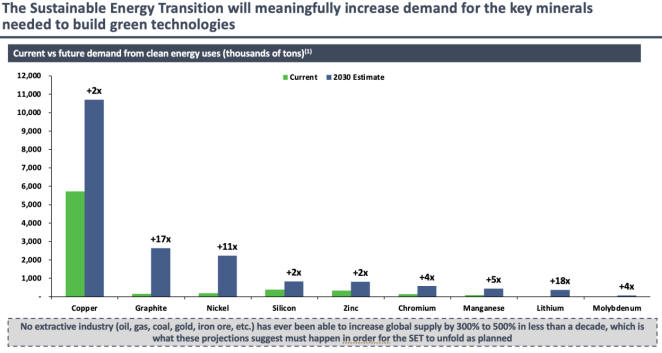

1) There will be major shortages within the next few years of the minerals used in renewable energy systems, leading to vastly higher prices for these minerals and increased mining activity.

2) On a global basis there will be extensive environmental damage, and for at least the next ten years there will be increased carbon emissions, due to the additional mining and manufacturing activity associated with building the renewable energy systems.

3) There will be periodic major shortages of natural gas, oil, oil-based products (diesel and gasoline) and coal due to under-investment in the production of these commodities, leading to the existing producers of these commodities becoming far more valuable.

4) The cost of energy as a percentage of GDP will be much higher this decade than in the preceding decade, leading to a lower standard of living for the average person.

5) There will be a large rise in the price of uranium, because the expansion of nuclear energy will become politically attractive (meaning: a vote winner) in the face of periodic energy shortages and extremely high energy prices.

As investors/speculators, we can’t do anything about the adverse social and environmental consequences of the accelerating trend towards ‘renewables’. However, we can attempt to profit from points 1), 3) and 5).

Print This Post

Print This Post