The answer to the above question is no, but it’s a trick question. Value is subjective and therefore can’t be stored, meaning that there is no such thing as a store of value. An ounce of gold, for instance, will be valued differently by different people. It will also be valued differently by the same person in different situations. For example, you might value gold highly in your present situation, but if you were stranded alone on an island with no hope of rescue then gold would probably be almost worthless to you. Rather than asking if gold is a good store of value it is more sensible to ask if gold is a good store of purchasing power in a modern economy, but this question does not have a one-word answer. It has a “yes, but…” answer.

Gold has been a good store of purchasing power in the past, but only reliably so when the initial purchase was made at a ‘reasonable’ price and the time period in question was extremely long. What I mean is that you can’t pay a ridiculously-high amount for an ounce of gold and reasonably expect the ounce to retain its purchasing power, even if the planned holding period is several decades. I also mean that if you buy gold at a time when it is being valued at a relatively moderate level you will be at risk of suffering a loss of purchasing power unless you are prepared to hold for decades.

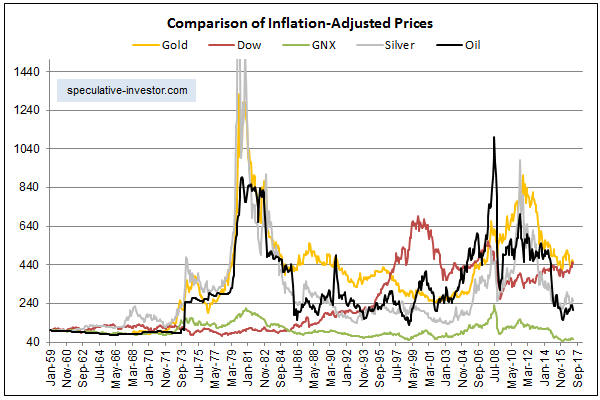

Now, it’s not possible to come up with a single number that reflects the economy-wide change in the purchasing power of any currency, but by considering the change in the US$ gold price over time and making some basic assumptions about the change in the US dollar’s purchasing power we can get some idea of how gold’s purchasing power has shifted. Here are some examples.

First, from its September-2011 peak to its December-2015 bottom the US$ gold price fell by about 45%. There’s no way of calculating the change in the US dollar’s purchasing power over this period (the official CPI and all unofficial CPIs are bogus), but we can be certain that the US$ lost purchasing power. We can therefore be sure that gold lost more than 45% of its purchasing power over this roughly-4-year period.

Second, from its January-1980 peak to its February-2001 bottom the US$ gold price fell by about 70%. Again, there’s no way of calculating the change in the US dollar’s purchasing power over this period, but we can be certain that the US dollar’s purchasing power was much lower in February-2001 than it was in January-1980. We can therefore identify a 21-year period during which gold lost substantially more than 70% of its purchasing power.

Third, anyone who bought gold near the January-1980 top (37 years ago) and held to the present day would still not be close to breaking even in purchasing-power terms, even though the nominal price is now about 50% higher. Moreover, it’s conceivable that buyers of gold near the top in January-1980 will never break even in purchasing-power terms, regardless of how long they hold.

Fourth, by making the same type of rough-but-realistic assumptions about changes in the US dollar’s purchasing power it can be established that there were two periods of 8-10 years over the past 5 decades when there were huge increases in gold’s purchasing power.

The point is that when gold is not money (the general medium of exchange) it tends NOT to maintain its purchasing power over what most people would consider to be a normal investment timeframe. Instead, gold’s purchasing power tends to experience massive swings. By being knowledgeable and unemotional you can take advantage of these swings. What you can’t reasonably expect to do is conserve your purchasing power by mindlessly buying gold at any price.

Print This Post

Print This Post