When a prosecutor is trying to establish guilt in a murder trial in most cases he will try to show that the accused had the motive, the means and the opportunity. However, prior to analysing motive, means and opportunity (MMO) there must first be evidence that an actual murder occurred. One of the most basic mistakes made by those who tout gold-price suppression stories is that they focus on the MMO without first establishing that a crime has taken place. The crime in this case would be causing the gold price to behave consistently in a way that was contrary to the underlying fundamentals.

Before getting to the absence of evidence that a crime has occurred let’s first deal with the MMO-focused argument, because even this argument has many holes in it. There is no question that the banking cartel that encompasses central banks and commercial banks has the opportunity to manipulate prices, given that it is a big player in the financial markets. However, it is not clear that “the cartel” has the means to manipulate the gold price beyond minor fluctuations over very short time periods.

One popular story is that the price is suppressed over the long-term via the “naked” short selling of gold futures, but you don’t need to go to the lengths to which the Monetary Metals team recently went to see that this story is fictitious. The bogus nature of the story can be seen by looking at the Commitments of Traders (COT) data. For example, if price declines were driven by the naked short selling of futures then the open interest (OI) in the futures market should rise as the price trends downward (as new short positions are added), but more often than not the opposite is the case. For another example, the COT data show that the “Commercial” traders, the supposed architects of the price suppression, are typically net buyers during price declines.

Another popular story is that the price is suppressed by creating paper supply in the London market. This story is based on the fact that there are a lot more claims to physical gold traded via the London Bullion Market Association (LBMA) than there is physical gold in LBMA vaults. This story is more difficult to refute, not because it is more likely to be true but because there is less transparency with LBMA gold trading than there is with Comex gold trading. However, for the sake of argument let’s make a huge leap of faith and assume that the LBMA provides the means to suppress the gold price beyond the very short-term.

We now turn to motive. The idea is that gold is a barometer of the monetary system’s health, with a rising gold price being indicative of failing health, and that the banking cartel wants us to believe that the monetary system is healthy even when it’s not. As part of the cartel’s efforts to create a false impression of monetary-system health, the gold price is prevented from rising to the great heights that would be reached if the market were left alone.

This line of thinking is on the right track, in that the gold price does reflect financial-system and economic confidence. The problem is that these days it is a very low-profile barometer — so low-profile that even when the gold price rocketed up to near $2000/oz in 2011 it generally wasn’t viewed as a sign that the US$-based monetary system was in danger of falling apart.

The reality is that the senior members of the banking cartel couldn’t care less whether gold was priced at $1100/oz, $1300/oz, $1500/oz or some other number. It’s likely that they care deeply about the currency, bond and stock markets, but rarely give the gold price more than a passing glance. However, for the sake of argument let’s again make a leap of faith and assume that the banking cartel has a strong motive to suppress the gold price.

In other words, despite the weakness of the supporting arguments let’s assume that the banking cartel has the motive, means and opportunity to suppress the gold price. This gets us back to the point made at the start, which is that establishing the MMO would be meaningless without evidence that the gold price has performed significantly worse than it should have performed.

Of course, to know how the gold price should have performed you must have some way of quantifying the fundamental backdrop and how it relates to gold. A rational analyst cannot do what most manipulation-centric commentators appear to do, which is blindly assume that the fundamental backdrop is always bullish for gold.

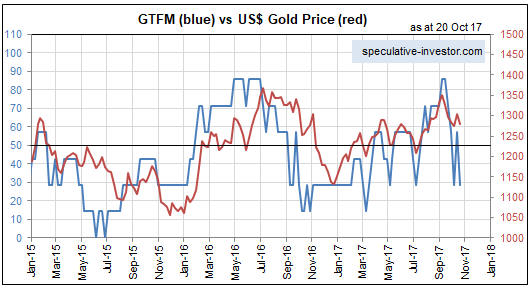

I developed a model that quantifies the extent that the fundamental backdrop is bullish for gold. The model was described in a June blog post and is based on the concept that gold’s value moves in the opposite direction to confidence in the financial system and/or the economy. The following chart compares the output of this model with the US$ gold price since the beginning of 2015.

Given that in addition to being affected by changes in the fundamental backdrop the gold price is also affected in the short-term by sentiment shifts, technical trading and knee-jerk reactions to random news events, the positive correlation evident on the following chart is as strong as reasonably could be expected. Furthermore, a positive correlation between the true fundamentals and the gold price is clearly evident back to 2002, which due to data limitations is as far back as I’ve been able to calculate the model.

In other words, the US$ gold price has done what it should have done over the years considering the shifts in the fundamental backdrop. This suggests that the effects of downward and upward manipulation (price manipulation happens in both directions) have been short-lived. It also suggests that there has been no EFFECTIVE price-suppression scheme.

I’ll end with an analogy. Bill Jones is accused of murdering Fred Smith and the prosecutor does a wonderful job of showing that Bill had the motive, means and opportunity to kill Fred. The problem is that Fred Smith is walking around, perfectly healthy.

Print This Post

Print This Post