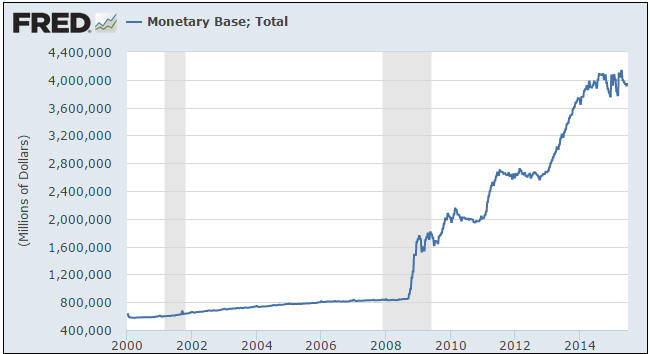

It’s not an overstatement to say that over the 6-year period beginning in September-2008, the US Federal Reserve went berserk with its Quantitative Easing (QE). The following chart shows that the US Monetary Base, an indicator of the net quantity of dollars directly created by the Fed*, had a gentle upward slope until around August of 2008, at which point it took off like a rocket. More specifically, the Monetary Base gained about 30% during the 6-year period leading up to September of 2008 and then quintupled (gained 400%) over the next 6 years. Is it therefore fair to say that the Fed has now ‘shot its load’ and will be unable to do much in reaction to the next financial crisis and/or recession?

Unfortunately, the answer is no. The sad truth is that the Fed is not only capable of doing a lot more, it will almost certainly pump a lot more money into the economy the next time its senior management decides that the financial or economic wheels are falling off.

The Fed is capable of doing a lot more because it is not yet remotely close to running out of things to monetise. For example, the US Federal debt is presently about $18.1T and will probably top $20T within the next two years. This means that there is plenty of scope for the Fed to add to its current $2.5T stash of Treasury securities. Also, the Fed is not strictly limited in what it can monetise. Up until now it has been monetising Mortgage-Backed and Agency securities in addition to Treasury securities, but it could branch out into other asset-backed securities (those backed by auto loans or student debt, for instance), municipal bonds, investment-grade corporate bonds, and equity ETFs. If the situation were perceived to be sufficiently dire it could even change the rules to allow itself to monetise commercial and residential real-estate.

And the Fed almost certainly will do a lot more on the money-pumping front in the face of future economic and/or stock market weakness, because it has not only failed to learn the right lessons from the events of the past 15 years, it has learned exactly the wrong lessons. Rather than learning that injecting more money into the economy in an effort to mitigate the fallout from a busted bubble leads to a bigger bubble, a bigger bust, greater hardship and structural economic weakness, its senior management is convinced that the QE and interest-rate-suppression programs provided a substantial net benefit to the overall economy. Given this conviction in the righteousness of its previous actions, why wouldn’t the Fed do more of the same if the perceived need were to arise in the future? The answer, of course, is that it would. And it will.

In conclusion, those who think that the Fed is incapable of further monetary expansion do not have a good understanding of the situation, and those who believe that the Fed could do more, but will choose not to as the result of newfound financial prudence or concern for the well-being of savers, are naive.

*The Monetary Base is made up of currency (physical notes and coins) in circulation outside the banking system plus bank reserves. Bank reserves aren’t counted in the True Money Supply, but for every dollar of reserves created by the Fed as part of its QE the Fed also adds a dollar of money to the economy via a deposit into the demand account of a Primary Dealer. That is, QE results in the one-for-one creation of money and reserves. For a more detailed explanation, refer to my 16th February 2015 post.

Print This Post

Print This Post