Governments and central banks lost interest in the gold price decades ago, but stories about how governments are supposedly controlling the gold price never lose their appeal. One of the latest stories is that since the inclusion of the Yuan in the IMF’s SDR (Standard Drawing Rights) basket in October-2016, the Chinese government has pegged the SDR-denominated gold price to 900 +/- a few percent. According to The Macro Tourist’s 25th July blog post, this story has been told by Jim Rickards. The Macro Tourist suggests a different story*, which involves the Chinese government (or someone else) having pegged the Yuan-denominated gold price. Both stories are based on gold’s narrow trading range relative to the currency in question over the past two years.

If we are going to play this game then I can tell an even better story. My story is that the Japanese government took control of the gold market in early-2014 and has since been keeping the Yen-denominated gold price at 137,000 +/- 5%. They lost control in early-2015 and again in early-2018, but in both cases they quickly brought the market back into line.

Here’s the chart that ‘proves’ my version of events:

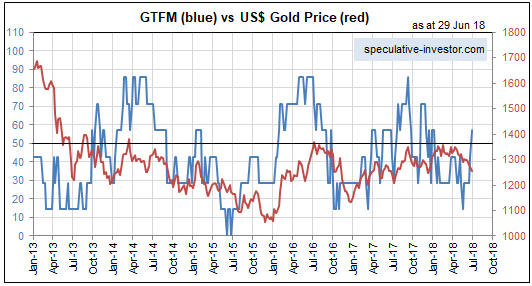

The narrow sideways range of the Yen gold price over the past 4.5 years is due to the Yen being the major currency to which gold has been most strongly correlated. Here’s a chart that illustrates the strong positive correlation between Yen/US$ and gold/US$:

My story about the Japanese government pegging the gold price makes as much sense as the stories about the Chinese government pegging the gold price. That is, my story makes no sense.

It will be possible to find price data to substantiate almost any manipulation story. Also, with sufficient imagination there is no limit to the manipulation stories that can be concocted to explain any price action. For example, you can always look at a period of range-trading in the gold market and conclude that a government (the same organisation that makes a mess of everything else it tries to do) is adeptly managing the price. Alternatively, you can look for a more plausible explanation or perhaps just acknowledge that not all price action has a single, simple explanation.

Like all financial markets the gold market is, of course, manipulated, but even if there were a desire to do so (there isn’t) it would not be possible under today’s monetary system for any government to directly control the gold price over a period of years or alter major trends in the gold price.

*In general the Macro Tourist blog provides level-headed commentary on the financial markets and doesn’t plunge into the murky world of gold-manipulation story-telling. Even in this case I think the main point of the post is to show that gold is stretched to the downside and may be good for a short-term trade, but some people will take the post as more evidence that the gold market is dominated by nefarious forces.

Print This Post

Print This Post