Last week I posted a short piece titled “A silver price-suppression theory gets debunked“, the main purpose of which was to direct readers to a Keith Weiner article disproving that the silver price had been dominated by the “naked” short-selling of futures. My brief post rattled the cage of GATA’s Chris Powell, who made an attempt at a rebuttal early this week and in doing so proved that 1) he doesn’t understand what arbitrage is and how it affects prices, and 2) he doesn’t understand what fundamental and technical analysis are (he seems to believe that any analysis that uses charts to display data is the ‘technical’ variety).

My approach to the gold market involves fundamentals, sentiment and technicals in that order, except when sentiment is extreme in which case it takes priority. To give non-TSI subscribers an idea of what I do, here’s a brief excerpt from the TSI commentary that was published on 8th October:

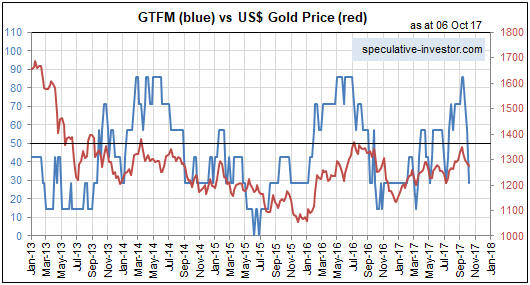

“Last week, two of the seven components of our Gold True Fundamentals Model (GTFM) flipped from bullish to bearish. We are referring to the bond/dollar ratio, which broke below its moving demarcation level, and the real interest rate (the 10-year TIPS yield), which broke above its moving demarcation level. As a result, five of the seven components are now bearish and the GTFM is well into bearish territory. Here’s the updated chart:

The gold market responds more immediately, directly and accurately to changes in the fundamental backdrop than any other major financial market. This means that there is often an easy-to-identify fundamental reason for any sizable multi-week move in the gold price, but it also means that changes in the fundamental backdrop often say more about the past than the future. For example, the fact that the fundamental backdrop was gold-bearish at the end of last week doesn’t imply that there will be additional short-term weakness in the gold price. Instead, it explains the weakness that has already happened.

That being said, an understanding of the true fundamental drivers of the gold price can be used to assess the future prospects for the gold price. For example, five of the seven components of the GTFM are either directly or indirectly influenced by the bond market, with T-Bond strength generally acting to shift these components in the gold-bullish direction and T-Bond weakness generally acting to shift these components in the gold-bearish direction. Therefore, a strong expectation regarding the future direction of the T-Bond price can feed into an assessment of gold’s risk/reward.

For example, it was partly the expectation of T-Bond weakness, potentially exacerbated by the Fed taking its first genuine step along the monetary tightening path, that three weeks ago caused us to become sufficiently concerned about gold’s short-term risk/reward to suggest buying some put-option insurance. This was despite the GTFM being well into gold-bullish territory at the time.

It is now the expectation of a T-Bond rebound that causes us to view gold’s short-term risk/reward as being skewed towards reward, despite the GTFM being well into gold-bearish territory.“