[This blog post is a modified and updated excerpt from a commentary published at TSI about three weeks ago]

In response to the 2007-2009 financial crisis, policy-makers in the US who had absolutely no idea what caused the crisis enacted legislation that would supposedly prevent such a crisis from re-occurring. The legislation is called “The Wall Street Reform and Consumer Protection Act”, although it is better known as “Dodd-Frank”. Unsurprisingly, considering its origins, the Dodd-Frank legislation has done nothing to reduce financial-crisis risk but has made the US economy less efficient. Quite rightly, therefore, the Trump Administration is intent on repealing all or parts of it. What are the likely consequences?

If Dodd-Frank were scaled back in a meaningful way it could make interactions between customers and their banks more efficient, but without knowing exactly which parts of the legislation are going and which parts are staying it isn’t possible to quantify the consequences. For example, a part of the legislation that will probably go is the requirement for banks to retain at least 5% of any loans they securitise. Eliminating this requirement would be slightly helpful to banks, but would make very little difference to the overall economy.

What we can say is that the efficiency-related benefits of meaningfully scaling back Dodd-Frank would be long-term, meaning that they probably wouldn’t have a noticeable effect over the ensuing year.

As an aside, it’s worth mentioning that there is a risk associated with eliminating parts of the economy-hampering legislation known as Dodd-Frank. The risk is that de-regulation will get the blame when the next crisis occurs, and the Federal Reserve, the primary agent of economic instability, will again get away unscathed.

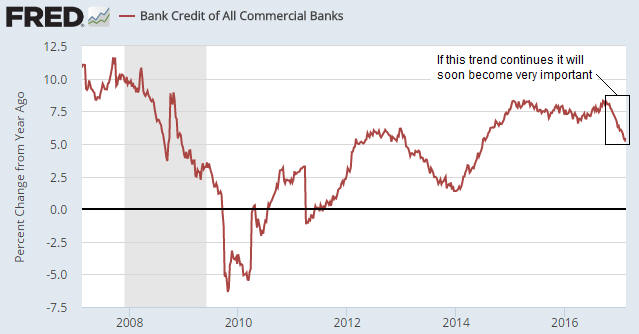

With regard to economic performance over the next 12 months, changes in the pace at which US banks collectively expand credit will likely be of far greater importance than changes in how the US banking industry is regulated. From a practical investing/speculating standpoint it therefore makes more sense to focus on the following chart than on the latest Dodd-Frank news.

The chart shows that after oscillating in the 7%-8% range for about 2 years, the year-over-year (YOY) rate of credit growth in the US banking industry has slowed markedly of late. As recently as late-October it was above 8%, but it’s now around 5.4%.

The steep decline in the rate of bank credit growth during 2013 didn’t have any dramatic economic consequences, but that’s only because the Fed was rapidly expanding credit via its QE program at the time. With the Fed no longer directly adding credit and money to the financial system, keeping the credit-fueled boom alive depends on the commercial banks. In particular, there’s little doubt that a further significant decline in the rate of commercial-bank credit growth would have a noticeable effect on the economy.

On a long-term basis the effect of a further decline in the pace of credit expansion would actually be positive, but on an intermediate-term basis it would be very negative because many activities and asset prices, most notably stock prices, are now supported by nothing other than the creation of credit and money out of ‘thin air’.

Print This Post

Print This Post