This blog post is an excerpt from a recent TSI commentary.

The following three charts tell an interesting story.

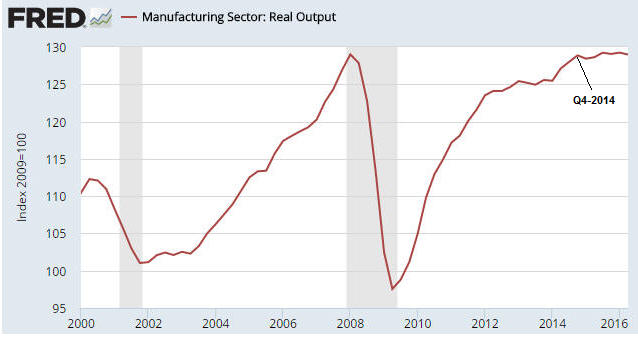

The first chart shows that the real output of the US manufacturing sector has essentially flat-lined since Q4-2014.

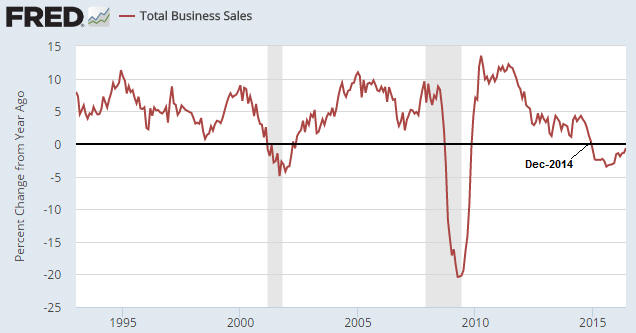

The next chart shows that Total US Business Sales has been down on a year-over-year basis during every month subsequent to December-2014.

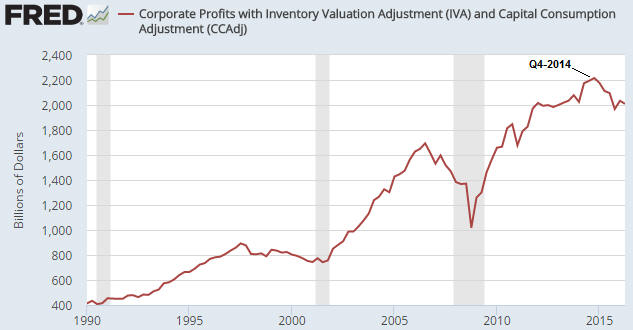

The third chart shows that US corporate profits peaked in Q4-2014 and in the latest completed quarter (Q2-2016) were almost 10% below their peak.

The story is that there has been a business recession in the US since the end of 2014. The business recession hasn’t yet transformed into a full-blown economic recession, but it will possibly do so within the next three months and it will probably do so by mid-2017.

The US business recession hasn’t been caused by the relatively strong US$. We know this firstly because a strong currency logically cannot be the cause of persistent economic weakness and secondly because the following chart shows that Net US Exports have improved slightly since the end of 2014.

Economic weakness outside the US has almost certainly played a part in the US slowdown, but the biggest part has been played by the Fed. Monetary policy has simultaneously caused stock prices to remain high and underlying businesses to languish, with the most obvious evidence being the favouring of debt-funded stock buybacks over capital investment.

Print This Post

Print This Post