[This blog post is an excerpt from a recent commentary published at speculative-investor.com]

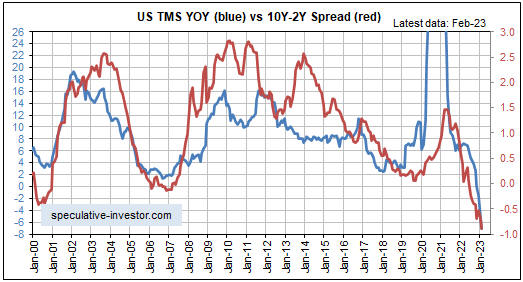

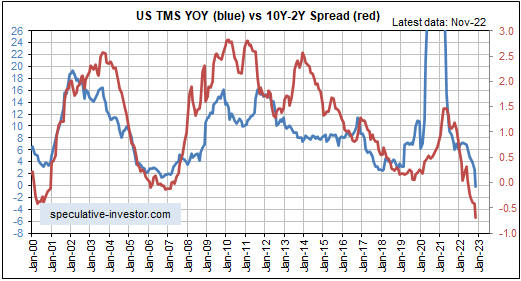

The US money-supply data for March-2023, which were published on Tuesday of this week, reveal that the monetary inflation rate has continued its ‘swan dive’. As illustrated below, the year-over-year growth rate of US True Money Supply (TMS) is now around negative 10%, that is, at the end of March-2023 the US money supply was about 10% smaller than it was a year earlier. The last time there was a double-digit annual percentage contraction in the US money supply was the early-1930s.

The Fed has signalled that it will maintain downward pressure on the money supply via its QT program, so a further decline in the monetary inflation rate is likely unless commercial banks lend enough new money into existence to counteract the Fed. So, what are the chances of the commercial banks generating enough new credit in the short-term to counteract the Fed?

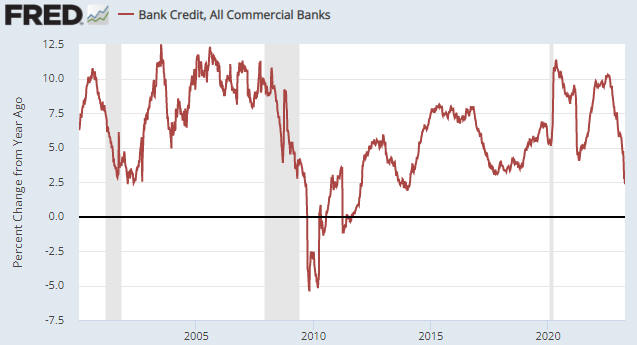

Given the stresses that recently have emerged in the banking system combined with the trend towards tighter commercial bank lending standards that was well underway before last month’s banking panic and the plunge in the rate of bank credit growth illustrated by the following chart, the chances are slim to none. That is, a further monetary contraction appears to be in store.

Just to recap, in 2020 the Fed flooded the US economy and financial markets with dollars in an effort to make it seem as if the government could impose major restrictions on economic activity for several months without causing widespread hardship. Then, throughout 2021 the Fed acted as if the monetary deluge of 2020 would have only minor inflationary effects, mainly because major effects were yet to appear in backward-looking statistics such as the CPI. During the first half of 2022 the Fed finally realised that its prior actions had caused a major inflation problem, and in response it embarked on an aggressive monetary tightening program. However, by the time the Fed started tightening, the monetary inflation rate already had collapsed from a high of almost 40% to around 7% and the rate of CPI growth was within three months of its cycle peak.

Now we have the Fed still in tightening mode even though a) the US economy has just experienced the largest money-supply shrinkage since the Great Depression and b) the CPI growth rate is about 10 months into a cyclical decline. Why? Mainly because the backward-looking CPI hasn’t yet fallen far enough to reach the Fed’s arbitrary target.

At some point during the second half of this year the Fed will realise that its monetary tightening has gone too far, and at around the same time it will start coming under political pressure to create the illusion of prosperity in the lead-up to the November-2024 Presidential Election. It then undoubtedly will begin to lean in the opposite direction, again with its eyes firmly fixed on the rear-view mirror (backward-looking data). This will set the scene for the next great inflation wave.

The Federal Reserve is like a loose cannon on the deck of a ship in a storm. It is crashing into things and generally wreaking havoc, although unlike an actual loose cannon it pretends to be the opposite of what it is. It pretends to be a force for financial and economic stability.

The problem is the institution itself rather than the current leadership. The current leadership is inept and dangerous due a lack of understanding of what’s happening in the world, a lack of understanding of how its own actions affect long-term progress, and a strong belief that it knows what’s best. However, giving an individual or a committee the power to manipulate the money supply and interest rates would be problematic even if those doing the manipulating were competent.

Print This Post

Print This Post