One of the most annoying claims made by manipulation-focused gold-market commentators is that evidence of market manipulation constitutes evidence of long-term price suppression. The claim is annoying not so much because it is obviously false, but because many people get fooled by it even though it is obviously false.

Experienced traders are well aware that banks and other large-scale operators regularly attempt to shift prices one way or the other in most financial markets to benefit their own bottom-lines. It has always been this way and it always will be this way. As I mentioned in previous blog posts (HERE, HERE and HERE, for example), when news emerges that banks have been caught manipulating prices in a market it isn’t really news at all.

Sometimes the manipulation is unethical and/or illegal (what’s illegal and what’s unethical aren’t always the same), but a lot of the price manipulation attempted by private operators in the financial markets is neither illegal nor unethical. A lot of the time it is a legitimate business practice.

From the perspective of manipulation-focused pontificators about gold, the big story over the past two years was the evidence that major banks had been scalping profits by manipulating the London Gold Fix. Deutsche Bank even settled lawsuits over allegations it manipulated gold and silver prices via the London Fix, thus providing plenty of grist for the conspiracy mill.

Assuming that banks were indeed using the twice-daily London Fix to manipulate gold prices, then in this case the manipulation was probably illegal and almost certainly unethical. If nothing else, it involved a breach of trust. However, as noted in a previous post on this topic the price manipulation that potentially occurred via the London Fix could only have affected prices by small amounts for very brief periods. Furthermore, the small effects would have been to both the upside and the downside.

The ‘news’ that banks used the London Gold Fix to illegitimately increase their profits is therefore completely irrelevant to the claim that there has been a successful price suppression scheme in operation in the gold market over a great many years. And yet, it has been portrayed as if it were the veritable “smoking gun” evidence of such a scheme.

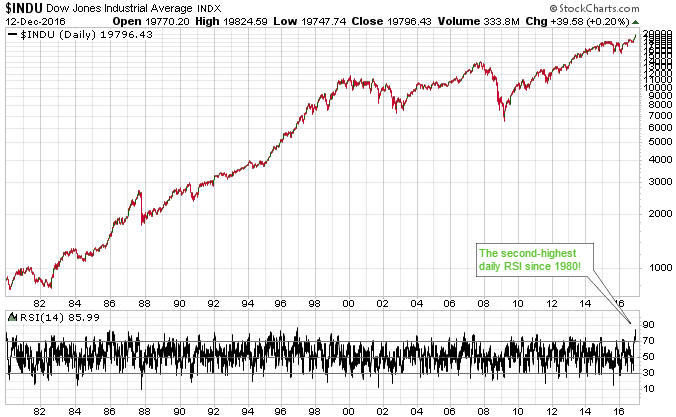

If the gold market had really been subject to price suppression over a long period then gold’s performance would be totally ‘out of whack’ with related financial markets. However, that is not the case. For example, the following chart shows the close relationship over the past three years between the US$ gold price and the bond/dollar ratio (the T-Bond price divided by the Dollar Index).

All of that being said, you are allowed to make money in the financial markets by doing something other than buying/owning gold. Therefore, if you truly believe that a powerful group has both the means and the motive to suppress the gold price then the solution is obvious: don’t buy gold.

Print This Post

Print This Post