The Fed unwittingly will continue to tighten

Posted By Steven Saville On December 18, 2018 @ 2:05 am In Uncategorized | Comments Disabled

The Fed probably will implement another 0.25% rate hike this week, but at the same time it probably will signal either an indefinite pause in its rate hiking or a slowing of its rate-hiking pace. The financial markets have already factored in such an outcome, in that the prices of Fed Funds Futures contracts reflect an expectation that there will be no more than one rate hike in 2019. However, this doesn’t imply that the Fed is about to stop or reduce the pace of its monetary tightening. In fact, there’s a good chance that the Fed unwittingly will maintain its current pace of tightening for many months to come.

The reason is that the extent of the official monetary tightening is not determined by the Fed’s rate hikes; it’s determined by what the Fed is doing to its balance sheet. If the Fed continues to reduce its balance sheet at the current pace of $50B/month then the rate at which monetary conditions are being tightened by the central bank will be unchanged, regardless of what happens to the official interest rate targets.

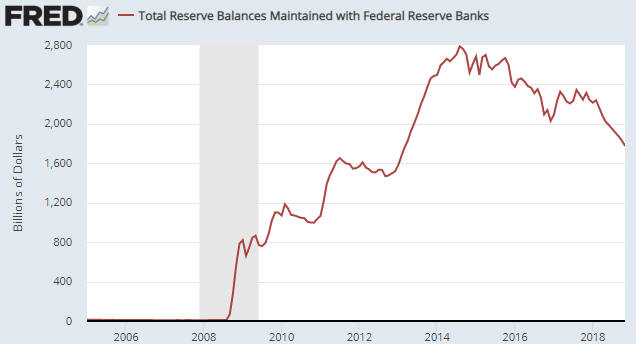

Another way of saying this is that a slowing or stopping of the Fed’s rate-hiking program will not imply an easier monetary stance on the part of the US central bank as long as the line on the following chart maintains a downward slope.

The chart shows the quantity of reserves held at the Fed by the commercial banking industry. A decline in reserves is not, in and of itself, indicative of monetary tightening, because bank reserves are not part of the economy’s money supply. However, when the Fed reduces bank reserves by selling securities to Primary Dealers (as is presently happening at the rate of $50B/month) it also removes money from the economy*.

I use the word “unwittingly” when referring to the likelihood of the Fed maintaining its current pace of tightening because, like most commentators on the financial markets and the economy, the decision-makers at the Fed are oblivious to what really counts when it comes to monetary conditions. They are labouring under the false impression that monetary tightening is effected mainly by hiking short-term interest rates and that the current balance-sheet reduction program is a procedural matter with relatively minor real-world consequences.

Therefore, over the next several weeks there could be a collective sigh of relief in the financial world as traders act as if the Fed has taken its foot off the monetary brake, followed by a collective shout of “oops!” when it becomes apparent that monetary conditions are still tightening.

*When the Fed sells X$ of securities to a Primary Dealer (PD) the effect is that X$ is removed from the PD’s account at a commercial bank and X$ is also removed from the reserves held at the Fed by the PD’s bank.

Article printed from TSI Blog: https://tsi-blog.com

Click here to print.