Whenever I write about gold-market manipulation in an effort to debunk the story that gold has been subject to a long-term price suppression scheme I am always careful to point out that ALL markets, including the gold market, are manipulated. They always have been and they always will be. Presenting evidence that the gold market is manipulated is therefore like presenting evidence that the Earth revolves around the sun — perfectly true, but not useful information in this day and age. However, whenever I write on the topic I invariably receive vitriolic responses in which I’m called a manipulation denier. Sigh.

The main point I was trying to make in last week’s blog post on this controversial topic is simply that evidence of gold-market manipulation is not evidence of long-term price suppression. Yes, if long-term price suppression has occurred then it would be an example of market manipulation, but market manipulation generally does not involve long-term price suppression. To further explain using an analogy, it’s a fact that a poodle is a dog, but armed with this fact it would be logically incorrect to point to an animal and say “that animal is a dog therefore it must be a poodle.” The animal might be a poodle, but there is a vastly greater probability that it is some other type of dog.

As far as I can tell, none of the evidence of market manipulation presented to date constitutes evidence of long-term price suppression. At best it falls into the “evidence that the Earth revolves around the sun” category — true, but not useful in this day and age. At worst it is designed to paint a misleading picture.

This brings me to the “London gold bias”, an issue that is often cited to support the long-term price suppression story.

I have been aware of the “London bias” in the gold market for a long time and dealt with it in a blog post about two years ago. It’s time to revisit the issue.

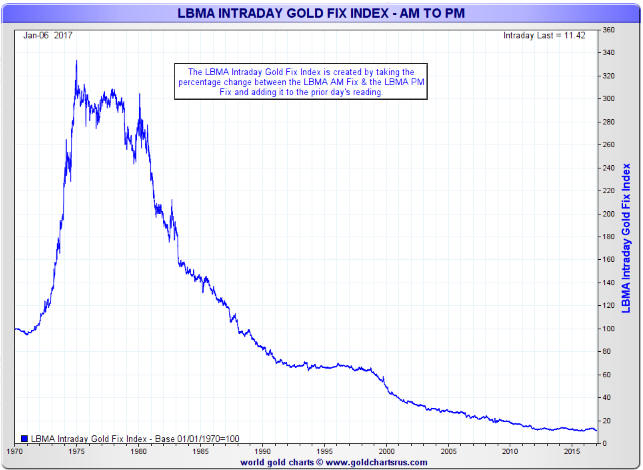

The idea behind the “London bias” is that there is a tendency for the London PM gold fix to be lower than the London AM gold fix. The result is that you would have lost money almost every year, through gold bull markets and gold bear markets, by simply buying a position at the London gold AM Fix every day and selling the position at the London PM Fix the same day. Here’s a chart from Nick Laird’s goldchartsrus.com web site illustrating the dismal performance that a hapless investor would have achieved if he had done exactly that:

That’s the type of chart that would be presented by someone who was keen to prove long-term price suppression. The thing is that by using exactly the same data a case could be made that the gold market has been subject to long-term price ELEVATION.

Here’s the backup for the above statement in the form of another chart prepared by Nick Laird, this time showing the performance that would be achieved by buying a position at the London gold PM Fix every day and selling the position at the London AM Fix the next day. This chart could be used to ‘prove’ upward manipulation of the gold price over a very long period.

The first of the above charts can be used to support the claim that the gold price has been unjustifiably suppressed and the second could be used to support the opposite claim. Furthermore, the claim of long-term upward manipulation supposedly supported by the second chart has an advantage in that it assumes manipulation during a part of the day when the market is relatively illiquid. If you were intent on manipulating a price in a particular direction over the long-term, would you be more likely to act during the most-liquid part of the trading day, when shifting the price would be most costly, or during the least-liquid part of the trading day, when shifting the price would be least costly?

In no way do I believe that the gold market has been subject to a long-term price elevation scheme. My point is simply that it is possible to ‘mine’ the same set of data in order to substantiate diametrically-opposed preconceived conclusions.

Humans love to find patterns and there are all sorts of patterns to be found in gold’s price action and the price action of every other widely-traded commodity or financial asset. However, these patterns often aren’t tradable, because if they were then they would be traded and the effect of the trading would be to make the pattern disappear. For example, if gold has a strong tendency to fall between time A and time B each day then there is money to be made by repeatedly selling at time A and buying at time B, but doing this trade in significant size will raise the price at time B relative to the price at time A and eliminate the opportunity.

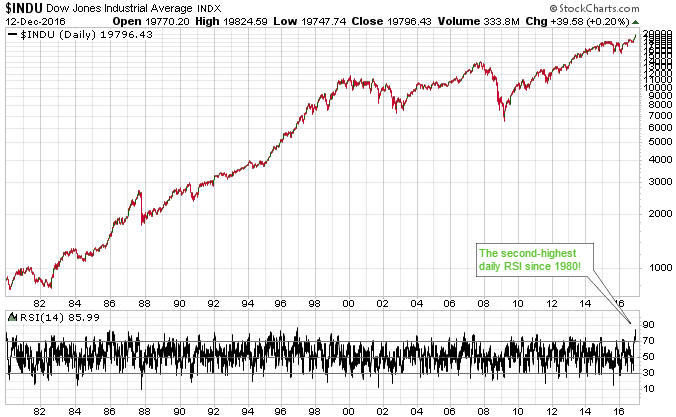

The very-short-term patterns in the gold market (the price rising at certain times and falling at certain other times during the day) must have cancelled each other out, because over the past 20 years the gold price has generally done what it should have done based on measures of economic and financial-market confidence (the true fundamental drivers of the gold price). Also, like most markets the gold market tends to overshoot in both directions, thus creating excellent profit-generating opportunities for investors and speculators who remain objective.

Print This Post

Print This Post